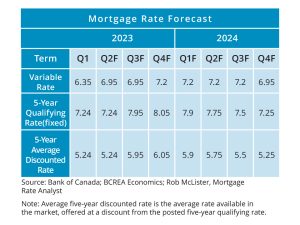

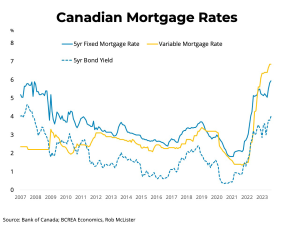

BRITISH COLUMBIA – Hotter than expected spring inflation and a resurgent housing market led the Bank of Canada to move off its conditional pause and raise its policy rate in both June and July. As a result, the average variable mortgage rate now sits at 6.95 per cent.

BRITISH COLUMBIA – Hotter than expected spring inflation and a resurgent housing market led the Bank of Canada to move off its conditional pause and raise its policy rate in both June and July. As a result, the average variable mortgage rate now sits at 6.95 per cent.

The Bank’s change in policy direction also sparked a shift in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid-2025, sending long-term interest rates significantly higher.

Yields on five-year Government of Canada bonds soared in August, surpassing 4 per cent for the first time in 15 years. Consequently, fixed mortgage rates have hit annual highs, nearing 6 per cent, the impact of which is compounded by an increasingly punishing stress test.

The combination of a slowing economy with inflation seemingly stuck in a range of 3 to 4 per cent muddies the outlook for rates over the next year. Our bet is still that the impact of high interest rates will tip the economy at least briefly into negative territory, and that consumer spending will slow once excess savings are finally exhausted.

However, with inflation not expected to return to target until 2025, households may be waiting longer than expected for relief on variable rates. We expect five-year fixed rates may start to come down in early 2024 as bond markets price in slowing inflation and future rate cuts by the Bank.

However, with inflation not expected to return to target until 2025, households may be waiting longer than expected for relief on variable rates. We expect five-year fixed rates may start to come down in early 2024 as bond markets price in slowing inflation and future rate cuts by the Bank.

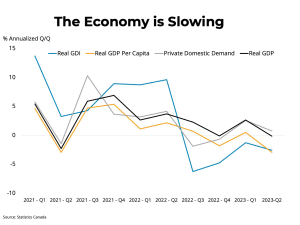

Economic Outlook

Higher borrowing costs may finally be making an impact on economic growth as the Canadian economy contracted at an annualized rate of 0.2 per cent in the second quarter, and the preliminary estimate for July showed zero growth. We expect the Canadian economy will manage to eke out modest growth for the year at 0.9 per cent.

While the economy appears to be slowing, or perhaps even contracting, it is difficult to label it a recession without a weakening labour market. The Canadian labour market continues to show remarkable resilience. Job growth has been mixed in recent months, and the unemployment rate is up slightly, though from record lows. Job vacancies are falling but remain elevated compared to historical norms. As a result, labour markets remain tight, and wages continue to rise at a 4 to 5 per cent rate.

Although inflation has fallen considerably from its June 2022 peak of over 8 per cent, it now seems mired in the range of 3 to 4 per cent, a level still unacceptable to the Bank of Canada. While it can be tempting to rationalize excluding various components of the CPI to achieve more favourable inflation numbers, the clear underlying trend for price growth does appear stuck above target. It may require additional monetary tightening to unstick the inflation rate and bring it back down to 2 per cent.

Although inflation has fallen considerably from its June 2022 peak of over 8 per cent, it now seems mired in the range of 3 to 4 per cent, a level still unacceptable to the Bank of Canada. While it can be tempting to rationalize excluding various components of the CPI to achieve more favourable inflation numbers, the clear underlying trend for price growth does appear stuck above target. It may require additional monetary tightening to unstick the inflation rate and bring it back down to 2 per cent.

Bank of Canada Outlook

With inflation trending above 3 per cent, the effects of prior rate hikes still have work to do to bring inflation back down towards the Bank’s target of 2 per cent. In our view, the Bank’s most recent decision to hold its overnight rate at 5 per cent was the right one, as it may take more time than previously thought for rate increases to work their way through a post-pandemic economy flush with household savings and transitioning back to services-driven growth.

That said, the uptick in core inflation observed in August will more than likely prompt an additional 25 basis point increase by the Bank of Canada.

At 5 per cent, the Bank of Canada’s overnight policy rate is 200 to 300 basis points higher than what the Bank estimates is “neutral” for the economy. At some point, inflation will return to its target, and the economy will no longer be experiencing excess demand, prompting the Bank to bring its policy rate back to its neutral rate of between 2 and 3 per cent.

However, because the Canadian yield curve is currently inverted, with long-term rates lower than short-term rates, which is contrary to their usual relationship, an eventual rate cut may not deliver as much fixed mortgage rate relief as expected. If we consider the five-year fixed mortgage rate as the sum of the Bank’s overnight rate plus a term and mortgage spread, the current term spread between five-year bond yields and the overnight rate is deeply negative.

As the yield curve normalizes, this term spread will again turn positive, negating a portion of future rate cuts by the Bank of Canada. We estimate a Bank of Canada overnight rate of 2.5 per cent implies a five-year fixed rate of 4.85 per cent, meaning that 250 basis points of rate cuts could result in just a 110 basis point drop in mortgage rates if the yield curve returns to its typical shape.