RUSS TAYLOR

This article was published in the Spring 2024 issue of the Truck Logger BC Magazine

BRITISH COLUMBIA – Net sawmill capacity in North America declined by 2 per cent in 2023 as slowing lumber demand and weaker markets made their mark.

A flood of sawmill expansions and new greenfield mills over the last six to seven years has added large amounts of lumber capacity, especially in the US South. These capacity increases have offset numerous mill closures, mainly in BC and the US West, with a few surprising closures in the US South, reported by Forisk Consulting. And as lumber prices moved below break-even prices in some regions in 2023, higher cost mills were closed, sometimes to rationalize timber supplies around multiple company sawmill sites.

In 2023, nine saw-mills were closed and so far in 2024, three new sawmills started operating in the US South, while six more sawmills an-nounced closures in North America.

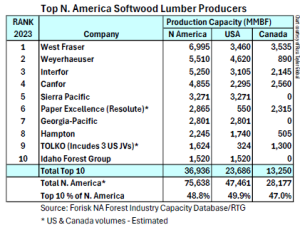

Forisk’s North America top ten soft-wood lumber producers’ ranking had an estimated 36.9 billion board feet of lumber capacity in 2023 and represented 49 per cent of total North American capacity. Five of the top ten companies have their head offices in Canada. West Fraser remains the largest producer in North America with seven billion board feet (bf) of capacity, while Weyerhaeuser and Interfor were closely grouped in second and third spot (see table).

@tla.ca

The top US softwood producers were led by Weyerhaeuser with 4.6 billion bf of capacity. The top ten companies had about 50 per cent of total US softwood lumber capacity. The top Canadian lumber producer was West Fraser with 3.5 billion bf of capacity. The top seven Canadian companies had about 47 per cent of total Canada softwood lumber capacity (see table), all with operations in the US.

In the North American lumber markets, March can often be in the middle of a two-to-three-month cycle of lower prices that typically run from mid to late January to late March. This is about what happened from mid-January through February in 2024, as W-SPF 2×4 prices slowly dropped. In late February 2023, lumber prices slumped badly through to mid-June, dropping US$100/Mbf and averaging only US$350/Mbf from early March to mid-June. In contrast to last year, since late February, W-SPF 2×4 prices (FOB mill) have been rising and were closing in on their 2023 peak price of US$460/Mbf and have eclipsed their earlier highs in January 2024. Things are looking better!

It is the US South, however, that has been experiencing very weak lumber prices. Normally southern yellow pine (SYP) lumber sells for about US$50-$70/Mbf (FOB mill) more than W-SPF. Currently, it is the reverse, as in early March it was selling at a US$60+/Mbf discount instead of a premium. This has resulted in some tempo-rary and permanent sawmill curtailments in the South—something not seen since the housing market collapse 15 years ago. Consequently, SYP prices need to move higher over the next few months, and it looks like this has already started in March.

Nevertheless, BC lumber prices are still near break-even levels due to constrained and expensive log supplies that make sawmilling so difficult in the province. So far this year, announcements include West Fraser’s (Fraser Lake) closure, curtailments or reduced output at Tolko Industries (Williams Lake) and Interfor (scattered mill reductions) among others, and reported temporary downtime or shift reductions at Dunkley, Teal-Jones and San Group.

The US market will probably be the most stable global market in 2024 despite having a few headwinds. High mortgage rates from global inflation and a short-age of existing homes for sale has been a benefit to new residential home builders. In 2024, US housing demand and housing starts are expected to remain relatively similar to 2023, depending on the impact of the pending recession. A net benefit to lumber demand is that more single-family houses are forecast to be started in 2024 than in 2023 and they consume three times the lumber as multi-family units.

Likewise, workers that are chronically underemployed will have to leave their employers and communities.

We can take care of both ecosystems and the economy

The OGSR states, “if we take care of the land, the land will take care of us.” But what exactly does it mean to “take care of the land?”

With its ecosystem-based approach to forest management, the draft BC Biodiversity and Ecosystem Health Framework philosophy appears to be that humankind should minimize its commercial use of forests. Forest-based activities should in-stead emphasize restoration activities (although the Framework does not provide any examples).

An alternative interpretation of “taking care of the land” could be “carrying out different management activities in different places.” For example, under the three-zone system recommended by the OGSR, the converted zone could include intensive silviculture. By zoning some of the land for industrial production and taking care of it for that specific purpose, British Columbians could continue to enjoy the economic benefits of logging, even while setting aside more land for conservation.

Conservation of key ecosystem elements can also be achieved (and may be enhanced) while carrying out forest management activities on the land. For example, wildfire mitigation activities can produce usable fibre while simultaneously improving forage for wildlife. The OGSR’s recommended consistent zone—land managed to simulate the pat-terns of natural disturbance—could even count as part of the conserved and protected lands included in BC’s 30 per cent.

Participants in the Gwa’ni project on Vancouver Island have commented that “everything is connected” in the landscape planning process—including logging roads and cutblocks. By integrating forestry activities at an early stage of landscape planning, the planning team was able to evaluate the cumulative effects of industrial activity, while still ensuring there was a place for it.

Healthy ecosystems are important, but they do not automatically ensure a healthy economy. BC forest policy needs to consider both. As the Gwa’ni project has shown, this is entirely possible.

In other major markets such as Europe, China and Japan, lumber demand so far in 2024 has been negatively impacted by oversupply, high interest rates and a lack of consumer confidence, creating flat re-sults at best. Essentially, the global lumber markets are not doing too well, as there is still too much supply chasing weak to maybe stable demand. The global out-look for 2024 is for flat to perhaps some increase in demand, but stable markets will still require a constrained supply. In 2024, this could be a challenge in some markets, although some very positive signs are now emerging in the US mar-ket. Most, including myself, expect the second half of the year to be better than the first; early signs indicate this could be very possible.

Russ Taylor is the President of Russ Taylor Global