RUSS TAYLOR

BRITISH COLUMBIA – North American and global lumber markets continue to struggle from soaring inflation, interest rates and energy costs, resulting in eroding demand and consumer confidence.

As 2022 wound down with more of a whimper, many wonder how tough it might be in 2023 and where lumber prices are heading.

Looking Back and Forward

In May 2022, when W-SPF 2×4 prices were over US$1,000/Mbf, I suggested that the W-SPF price would fall back into the mid-US$500s by late August. And that is exactly where lumber prices ended up.

In early September 2022, my outlook was for W-SPF prices to trade mainly between the mid-US$400s and mid-$500s until the end of the year before the real impact of a potential US recession hit, most likely in 2023-Q1. Between early September and early December 2022, W-SPF lumber pric-es have traded between US$365 and $520/Mbf, which was at the lower range of my early September outlook.

Trying to forecast commodity lumber prices is a minefield, as many scenarios, factors and assumptions must be incorporated. However, the range in lumber price forecasts, as well as US housing starts by forecasters always cover a wide range and it always amazes me how these forecasters keep their jobs despite being wrong so much of the time!

I published quarterly lumber price forecasts starting in 1989 and then monthly prices from 2000 to 2020. My track record has been better than the analysts and economists simply because I have spent so much time in the field and at sawmills, where I have looked more at the supply side dynamics rather than the demand side, which is where the others seemed to be focused.

I published quarterly lumber price forecasts starting in 1989 and then monthly prices from 2000 to 2020. My track record has been better than the analysts and economists simply because I have spent so much time in the field and at sawmills, where I have looked more at the supply side dynamics rather than the demand side, which is where the others seemed to be focused.

However, the analysts and economists can never accurately predict housing starts (representing 30 per cent of lumber demand), so that is the start of their forecasting errors.

In looking ahead to 2023, my outlook is on the pessimistic side. However, I expect lumber prices will have potentially started rallying sometime later in December through to the middle of first quarter 2023 before slowing down. The reasons are many, but mainly due to building material dealers maintaining low inventories through the winter. When they start to order their lumber, it will likely be close to the same time and that will extend sawmill order files for several months and cause prices to move higher before they inevitably fall back.

Over the year of 2023, I expect W-SPF prices will be volatile at times and could range from US$400 to as high as $650/Mbf. However, I expect the average price for the year to be close to US$500/Mbf.

Other Forecasts

When I compare my outlook to the forecasts of other forest products analysts, I am at the lower range of these forecasts: they range from US$475 to $595, with an average price of $523/Mbf for W-SPF 2×4 (FOB Mill).

And there are some absolutely wild forecasts out there for 2023-Q4 from some algorithm-based groups that bet on the Lumber Futures Market:

- Trading Economics: US$367/Mbf in 2023-Q4

- Wallet Investor: US$578/Mbf in 2023-Q4

- Gov.capital: US$990/Mbf in 2023-Q4

These forecasts are wildly different, which is why lumber forecasters can be hard to believe.

In the end, all forecasters, including myself, will be wrong, as the assumptions and drivers considered will always be changing, and you can only be lucky if your forecast is even close to the actual. Essentially, lumber forecasters are placing an educated bet on their forecasts despite all the wildcards and unknowns ahead. In any event, my outlook is presented for readers of Truck LoggerBC magazine.

BC Interior and Coast Outlook

For BC Interior sawmills in 2022-Q4, most mills were losing money when lumber prices moved below US$500/Mbf in 2022-Q4; so far, prices have ranged from $365 to $470/Mbf and were at US$365/Mbf (as of December 2)—at least $100/Mbf below breakeven levels.

Government stumpage rates have dropped from their massive peak in 2022-Q3, providing some preliminary relief this quarter and further reductions will occur in 2023-Q1 as the stumpage formula finally incorporates lower lumber prices from three to four months previous.

I estimate BC Interior mill variable costs in 2022-Q4 at around US$500/Mbf and total costs closer to US$550/Mbf. This is why numerous BC Interior sawmills have been curtailing throughout the fourth quarter as BC continues to be the highest cost producing region in North America due to its punitive (and market-lagging) government stumpage charges. In 2023-Q1, stumpage rates will drop further, lowering total costs and making mills more competitive with the rest of North America.

It is more difficult to evaluate BC Coast sawmills as the species, grade of logs, products, markets and other aspects complicate any simple evaluation. However, if Western Forest Products’ results are used as a proxy for the Coast, their 2022-Q3 results were marginal (and deteriorating) after some great results earlier in the year. Not only are Coast mills facing a declining log supply, especially old-growth logs, there are high Coastal stumpage costs, weakening global wood products demand, a weaker Japanese yen (20 per cent since the start of 2022) plus high inventories, slow demand in China for logs and lumber, and slowing housing demand in the US.

All these factors do not bode well for Coastal BC sawmills in 2023, especially in the first half. However, repair and remodelling activity is expected to be positive and that represents the highest volume segment of lumber use (40 per cent) in North America.

BC Interior and Coast Lumber Production Outlook

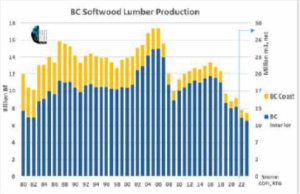

From the many ongoing government forest policy initiatives (such as old-growth deferrals, caribou protection, First Nations consultation, etc.) plus the impacts of beetles and forest fires, the BC Interior pro-duction continues to drop (and could be low-er in 2023 than in the 1981-1982 recession):

- 1987 peak (no beetles): 11.2 billion Bf

- 2006 peak (beetles): 15.0 billion Bf

- 2022 estimated: 7.0 billion Bf

- 2023 outlook: 6.6 billion Bf (41 per cent decline from 1987; 56 per cent decline from 2006)

For the BC Coast, the decline in total pro-duction has been even more severe:

- 1987 peak: 4.67 billion Bf

- 2022 estimated: 0.96 billion Bf

- 2023 outlook: 0.90 billion Bf (81 per cent decline from 1987)

With emerging government forest policy, high stumpage rates and plunging timber supplies, it becomes quite obvious why outside (and many inside) investors would have difficulty considering BC for forest products investments.

Russ Taylor is a global wood business and market consultant with over 45 years experience. Russ Taylor Global – Wood Business & Market Consulting is a continuation of the strategic work that Russ has always been doing with industry clients throughout his career.