As seen in Winter 2024 Truck LoggerBC

Market Report

RUSS TAYLOR

BRITISH COLUMBIA – In October 2023, I travelled for one week in Europe and two weeks in China to obtain a first-hand view of industry and market conditions. From these travels, my personal view and observations on the European and China log and lumber markets are that the real situation is probably worse than what is being reported. Or, at least, it is going to take until sometime next year for a recovery.

The following analysis is based on a conference and field trip in Europe and field work in China where I conducted over 40 interviews and meetings.

China Market

Overall consumer sentiment in China is at a 12-month low as there continues to be lingering concerns over the future of the Chinese construction market. This has been a key driver of the economy (previously up to 24 per cent of GDP, now closer to 19 per cent), and wealth of Chinese citizens. With the construction industry awash in massive debts and no clear path ahead, this is having a negative impact on end users’ demand for imported logs and low-grade lumber for use in construction.

Inventories of logs and lumber at ocean ports and distribution yards are very low in China, especially when compared to previous years. Some Scandinavian and Russian lumber exporters thought that October was a good time to raise lumber prices in China, and saw-falling (appearance) grade quotes were increased from US$220/m3 to US$260/m3. These high prices were not at all tied to demand, although the furniture and decoration markets were at least stable. The low inventories simply reflect a general lack of business and limited interest in hold inventories. Consequently, by early November, prices had settled back to US$230/m3.

Since sanctions were introduced on Russian exports, several new shipping lines are now servicing the port of St. Petersburg. There is currently a glut of empty containers, and container rates to China and other destinations have plummeted from US$2,000 – $3,000 per container to under US$500. Since the start of the third quarter, container shipments from Western Russia to China have picked up significantly and these lower cost lumber volumes have started to increase the inventories at Chinese ports.

The low-grade market is particularly weak in China, as much of this lumber ends up in concrete forming. During my 15 days in China, I counted hundreds of building cranes on new construction projects, but only saw two working! There is a real freeze on new construction in China due to the instability and debt loads of construction firms across the entire property market.

The plight of the low-grade W-SPF (and Hem-Fir) lumber importers in China is one that I heard often during my travels. In April 2022, W-SPF #3 lumber prices reached a high of US$280/m3 (US$433/Mbf) cost, insurance and freight China; after that, prices consistently moved lower month-over-month and one year later were US$160/m3 (US$248/Mbf), where they have remained. This constant price decay has meant huge losses for W-SPF importers and distributors in China and is a symptom of the declining construction and concrete forming business.

As 2024’s Lunar New Year is not far away, many buyers are carefully watching their purchases—as well as the construction and retail markets—and are planning to conservatively manage their inventory so they are prepared for any potential market slump. Of course, if their bet is wrong and demand picks up, the ultra-low inventories in China would mean that exporters could raise their prices to take advantage of the importers’ need to buy. In a sense, this could be a win-win, but only if it is sustainable and not a three-month hiccup.

Chart courtesy of Russ Taylor

US Market

Right now, the US is probably the most balanced market, but that is nothing to boast about. The fourth quarter is always quiet where there is typically slowing demand against surplus production.

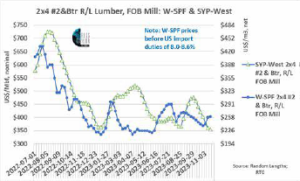

US lumber market prices had been slipping for many weeks but looks to have bottomed out (for now). In late October, W-SPF 2×4 #2&Better random length bottomed at US$370/Mbf (US$239/m3), freight on board (FOB) BC mill, after a nine-week slide representing a 10 per cent decline. Since then, prices have moved up to US$403/Mbf (as of December 1) as part of the “normal” November price cycle recovery.

So far, for Southern Yellow Pine (SYP), the fourth quarter story is bleak. SYP-West #2&Better random length has been collapsing: in late September, SYP 2×4 was sitting at US$477/Mbf; in late November, it finally bottomed out at US$355/Mbf, FOB mill—a drop of -US$122/Mbf (-25 per cent) in just seven weeks and is now trading at a US$40/Mbf discount to W-SPF. This is never a good situation, as normally SYP has a US$50-$60/Mbf premium.

And even more shocking are the prices for SYP 2×6 and 2×8—they are trading at US$60-$75/ Mbf discounts to SYP 2×4. And for the first time in many years, sawmills in the US South are approaching loss positions and curtailments are looming. The price graph shows the wild and abnormal price swings during 2023 between 2×4 W-SPF and SYP-West.

Mills are aware that if they curtail, they risk losing key sawmill and logging employees as well as existing customers. So, most curtailments are being postponed, and this strategy, in turn, puts too much lumber into a fragile market and further price reductions are likely until more balance can return to an over-supplied market. However, curtailments are inevitable, and when mills start to take downtime, this will likely give some urgency for buyers to increase purchasing, leading to price improvements, especially in SYP.

Russ Taylor is President of Russ Taylor Global