CHRIS DUNCAN

As seen in Truck LoggerBC Winter 2025

BRITISH COLUMBIA – On April 16, 2024, the 2024 federal budget, titled Fairness for Every Generation, was delivered by the Honourable Chrystia Freeland, deputy prime minister and minister of finance, which announced the increase in tl1e capital gains inclusion rate from 50 to 66.67 per cent The full implications of this rule mange will impact contractors but will not be known until legislation is finalized and passed into law.

Capital gains inclusion rate

The capital gains inclusion rate has increased from 50 to 66.67 per cent for corporations and most types of trusts for capital gains realized on or after June 25, 2024. Additionally, for individuals and select types of trusts, the inclusion rate also rose from 50 to 66.67 per cent on the portion of capital gains exceeding a $250,000 threshold realized in a year.

Capital gains realized by corporations Contractors that realize a capital gain in their corporation will pay about 7 to IO per cent more income tax on capital gains realized on or after June 25, 2024, depending on their province of residence.

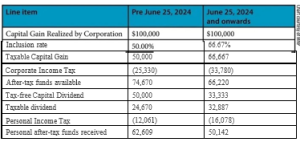

Consider the following example for a Contractor. The contractor’s corporation sells a piece of equipment and incurs a capital gain of$100,000. They will pay an extra corporate income tax of $8,440 for selling the equipment on or after June 25, 2024, compared to if it was sold prior to this date. This is due to more corporate income tax with the higher capital gains inclusion rate, leaving less cash available in the corporation.

The corporation cannot pay as high of a tax-free capital dividend to the contractor with the increased capital gains inclusion rate. In addition, the contractor will pay more personal income tax because a higher taxable dividend will need to be paid to extract all the sale proceeds after corporate income tax has been paid (this is illustrated in table on page 13).

Capital gains realized by individuals: under $250,000

The first $250,000 of capital gains realized by an individual in a particular year will remain taxable at a 50 per cent inclusion rate. Therefore, contractors will pay the same income tax when realizing a capital gain on or after June 25, 2024, then they would have paid if they realized a capital gain before June 25, 2024, if the total capital gains realized in a particular year is less than $250,000.

Capital gains realized by individuals: more than $250,000

Contractors that realize total capital gains of greater than $250,000 in a particular year will pay additional personal income tax on or after June 25, 2024, compared to if they realized capital gains prior to this date. The amount of income tax paid will depend on the individual’s province of residency.

It will also depend on the total amount of capital gains incurred in a particular year because the first $250,000 of capital gains are subject to the 50 per cent inclusion rate whereas the capital gains beyond $250,000 are subject to the 66.67 per cent inclusion rate.

Consider the following example: John is a contractor that personally owns the property in which they operate their business. John sells the property and in curs a capital gain of $1,000,000. John will pay additional personal income tax of $67,500 for selling the property on or after June 25, 2024, compared to if the property was sold prior to this date. This is because the first $250,000 of capital gains will be taxed with an inclusion rate of 50 per cent, whereas the remaining capital gain will be taxed with an inclusion rate of 66.67 per cent.

What it means to contractors

Anyone looking at selling equipment or other assets inside of a company at a gain will face more corporate tax. Con tractors looking to sell real estate, in vestments, and other personal assets at a gain may face additional tax. Contractors need to plan their exits ahead and ensure that they have their personal estate matters taken care of or be prepared for their heirs to pay more tax.

Chris Duncan, CPA,CA National Leader, Forestry & Forest Products Services, MNP