RUSS TAYLOR

Truck LoggersBC Magazine Summer 2023

BRITISH COLUMBIA – Over my almost 50-year career, I have watched the evolution of the BC forest industry in conjunction with the always-changing provincial governments and their respective forest policies.

Honestly, I have never understood how government works, especially when it comes to BC’s forest policy. After attending the COFI conference in Prince George and hearing two ministers and the premier speak, I continue to remain perplexed and worried about the future of BC’s forest industry. Clearly, politicians are playing to the urban voters and their own re-election, not to forest industry-based communities that rely on forests and forest industry jobs. A pessimistic view? Perhaps. A realistic view? I think so.

Operating logging and wood processing plants in the forest industry on government-owned timberland can be a real curse at times, as forest policies by incumbent governments can be invented or flipped so quickly to appease their voter base. For those who have invested in, and those whose livelihood are tied to the BC industry, these times are about as challenging as one can find. Not only are timber AACs declining, timber supply reductions are being further accelerated by government forest policy and timed to terribly low commodity lumber and OSB prices.

Moving on to markets and drivers where the story is not much better, there is still too much supply in North America as well as globally that continues to chase fickle demand. Higher interest rates, slumping consumer confidence and concerns about a potential recession later in the year continue to be some of the key drivers impacting new residential housing starts and more recently, repair and remodelling activity.

The first quarter 2023 results from Home Depot and Lowe’s are further evidence of slowing consumption as both retailers reported negative quarterly same-store sales. Customers skipped big-ticket items like grills and opted for smaller, less expensive home projects. At the same time, colder and wetter weather in the western US coupled with falling lumber prices were also responsible for lower dollar sales.

During COVID-19 there was a spree of pandemic-fueled home projects, but these have faded as consumers juggle other spending priorities such as commutes, summer vacations and restaurant meals. As a result, both companies indicate that their same-store sales over the next nine to twelve months will be lower by 2-5 per cent. With repair and remodeling representing 40 per cent of US lumber consumption, this is not good news. At least US housing starts seem to be trending higher, but they are at much lower levels than the last two years.

Commodity lumber prices have been below cost for BC Interior SPF sawmills for essentially all of 2023 and currently remain near the incredibly low price of US$350/Mbf, FOB mill for 2×4 random length lumber (as of June 9, 2023). The massive and unusual premium held by southern yellow pine earlier in the quarter has shrunk from US$175/Mbf to US$46/Mbf, or close to the historic spread of US$50-75/Mbf.

Not even Alberta’s huge forest fire state of emergency situation along with wildfires across other areas in western Canada could spark any interest in SPF lumber purchases in late May. Instead, buyers maintained steady but lean inventories on all SPF widths and filled in from local distributors or wholesalers as needed.

My lumber demand outlook for 2023 calls for a 4-6 per cent reduction in North American consumption compared to 2022. The one wildcard that I am most worried about, that seems to be brushed off now, is the pending credit crunch at US banks. Despite no further bank failures, there is the potential for a more severe second round later in the year that could be a more serious recession with all the demand reduction and job losses associated with this event. Further updates to follow on this looming issue.

With soft demand, supply will see reductions in most regions of the US and Canada, except for the low-cost US South. BC production is expected to be lower in 2023, up to 10 per cent in the Interior and around 5 per cent from the Coast, where other regions should see smaller reductions. Offshore US imports are already trending lower as US prices are now too low to attract any sustained volumes.

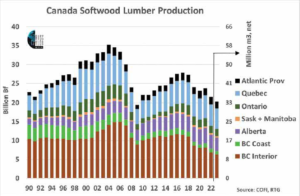

Looking back, BC was 62.6 per cent of Canada’s total output in 1990; in 2023 it will be about 35 per cent. Canada has normally been 32-34 per cent of US consumption; in 2023, it will be about 23 per cent. These declines are from reduced production in BC from either a lack of available timber or excessively high delivered log costs.

Export markets are also flat with Japan, China and Europe all seeing flat to lower demand as there are surplus supply volumes that are currently depressing wood products prices around the world.

It looks like W-SPF 2×4 prices are going to struggle for the rest of 2023 and will be lucky to average only US$400/Mbf, FOB mill. With BC costs above this level, it could be a blowout year for the industry. However, the government will still collect its stumpage revenues from a shrinking available timber supply and more companies must consider curtailments or closures.

I wonder if the government’s supporters really understand anything about the financial benefits, revenues and jobs that come from harvesting BC forests and processing logs into a variety of forest products?

Russ Taylor, President Russ Taylor Global (former President of International WOOD MARKETS Group) Tel: 604-897-5666 Email: russtaylor@russtaylorglobal.com Website: russtaylorglobal.com www.tla.ca