CHRIS ATCHISON

BRITISH COLUMBIA – Statistics reported in the Spring 2024 BC Construction Association (BCCA) Construction Industry Stat Pack and BCCA’s annual BC Construction Industry Survey Report show that while workforce numbers have improved over the past five years, it may not be enough for employers in BC’s construction industry who continue to face extreme pressures. This year’s industry survey report includes our bi-annual wages and salaries analysis, with highly favourable indicators for those considering a career in BC’s construction industry, but areas of concern for those who employ them.

Demand for construction remains high in British Columbia, with major projects currently underway at an estimated value of $160B, an increase of $3B over the past six months. This represents an increase of 39% over the past five years. However, at $170B, the estimated value of proposed major projects remains at lower levels than in Spring 2023, when proposed projects were valued at $221B.

A majority of contractors are enduring pressure from a number of sources:

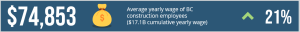

Labour shortages mean higher wages and steep competition for qualified workers. 77% of employers report increasing wages in the past year. The average annual wage in BC’s construction sector has climbed 21% over five years to $74,853. Survey respondents report that the average entry level wage sits at $22.11/hour, which is 25% above minimum wage, while the average wage of tradespeople with 10 or more years’ experience sits at $42.71/hour. The majority of workers work full-time and year-round, and report receiving overtime pay and health benefits. Journeypersons and Red Seal tradespeople are most likely to belong to a union, whereas Apprentices are most likely to change employers for higher pay.

Payment uncertainty and the lack of Prompt Payment legislation continue to preoccupy BC’s construction industry employers, some 92% of which are small businesses with fewer than 20 employees. The majority of contractors report being regularly paid late for work completed. 76% do not have their 10% lien holdbacks released in a timely manner. 62% report not being paid at all for work completed in the past year on at least one occasion. 17% of small companies, 36% of medium-sized companies and 42% of large construction companies report having entered into a contract dispute in the past year. BC’s small and medium-sized construction companies report worrying about permitting and inspection timelines and lack of prompt payment legislation. 64% of Industrial, Commercial and Institutional (ICI) survey respondents also build residential projects; lack of payment certainty affects companies that are key to solving BC’s housing crisis.

The provincial government continues to fail to deliver on a simple and available solution which would provide immediate relief to a struggling construction sector: prompt payment legislation. As BC’s contractors wait months for payment, they experience significant financial risk and take on the increased cost of debt, which can put them in danger of bankruptcy. They are put in the position of “financing” construction projects, including the housing BC desperately needs. Coupled with prompt payment, Lien reform including mandatory holdback release and adjudication remain additional priorities for BC’s construction industry.

“We have asked the Eby government time and time again to respect the hard-working people and small business owners of BC’s construction industry by ending payment uncertainty through Prompt Payment Legislation,” states Chris Atchison, BCCA President. “Construction is the province’s number one goods sector employer. To see yet another legislative cycle pass without enactment of commonsense legislation already available in other Canadian jurisdictions is shocking. What’s taking so long?”

Workforce trends

The construction industry’s skills shortage has improved significantly over the past five years. Although the industry still projects a deficit of 6,600 skilled workers by 2033, that is a substantial improvement from the 26,100 short-fall estimated for 2023 a decade ago.

The construction industry’s skills shortage has improved significantly over the past five years. Although the industry still projects a deficit of 6,600 skilled workers by 2033, that is a substantial improvement from the 26,100 short-fall estimated for 2023 a decade ago.

Despite 9% growth in the number of ICI construction companies in BC over the past 5 years (28,014), the number of tradespeople in the industry has dropped 7% over five years (167,300). The average company size has contracted by 15% over the previous 5 years to an average of 5.97 skilled trade workers.

“That a majority of workers in BC’s construction industry confirm that they would recommend a career in construction to friends and family is an encouraging sign at a time when recruitment is desperately needed,” believes Atchison. “There is absolutely no lack of employment opportunities for anyone interested in exploring a career in construction. Today’s worksite is a much more welcoming and inclusive place than even a decade ago. That work continues; tradespeople and labourers repeatedly tell us how important positive workplace culture is to them. Everyone, including members of traditionally underrepresented groups, should feel welcome within BC’s construction industry.”

“That a majority of workers in BC’s construction industry confirm that they would recommend a career in construction to friends and family is an encouraging sign at a time when recruitment is desperately needed,” believes Atchison. “There is absolutely no lack of employment opportunities for anyone interested in exploring a career in construction. Today’s worksite is a much more welcoming and inclusive place than even a decade ago. That work continues; tradespeople and labourers repeatedly tell us how important positive workplace culture is to them. Everyone, including members of traditionally underrepresented groups, should feel welcome within BC’s construction industry.”

The 2024 BC Construction Industry Survey was conducted during the Fall and Winter of 2023-2024. Insight gleaned from a total of 1,854 survey respondents (48% employers & their representatives, 47% tradespeople/ labourers and 5% professionals serving the industry), across industrial, commercial, institutional (ICI), and residential (multi-unit & single-family) sectors, and from all seven development regions of British Columbia combine to present a representative portrait of the industry’s current realities.

KEY BC CONSTRUCTION INDUSTRY STATISTICS:

- Construction is the No. 1 employer in BC’s goods sector.

- BC’s construction industry accounts for 10.3% ($27B) of the province’s GDP.

- 229,100 people rely directly on BC’s Construction industry for a paycheque.

- Number of workers in trades jobs: 167,300, an increase of 3,400 since Fall 2023 but still a 5-year trend decrease of 7%.

- Number of women in construction trades: 9,536 (5.7%), an increase of over 2,100 since Fall 2023 and a 5-year trend increase of 24%.

- Number of construction companies in BC: 28,014 an increase of over 1,750 since Fall 2023.

- Average yearly wage of BC construction employees: $74,853 ($17.1B cumulative yearly wage), an increase of over $2,600 since Fall 2023 and a 5-year trend increase of 21%.

- Value of proposed construction projects in BC: $170 billion, a decrease of $4 billion since Fall 2023.

- Estimated value of current major construction projects underway in BC: $160 billion, an increase of $3 billion since Fall 2023, and a 5-year trend increase of 39%.

- Number of construction jobs in BC that will be unfilled due to labour shortages by 2033: 6,600, an increase of 600 when compared to 2032 forecasts made in Fall 2023.

To consult the Spring 2024 BC Construction Association Industry Stat Pack visit bccassn.com/2024SpringStatPack.

The 2024 BC Construction Industry Survey Report is available at bccassn.com/2024IndustrySurvey.

Details regarding data sources can be found at bccassn.com/2024StatPackSources.

Source; bccassn.com