BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.9 per cent on a year-over-year basis in October, a rate of change equal to the prior month.

BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.9 per cent on a year-over-year basis in October, a rate of change equal to the prior month.

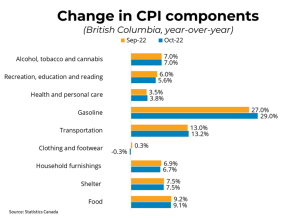

After falling for the prior three months, a rise in gasoline prices in October kept the CPI steady year-over-year. Excluding energy, the CPI rose 6.2 per cent year over year in October, down from 6.3 per cent last month.

Rising interest rates also contributed to an increase in mortgage interest costs, which was up 11.2 per cent year-over-year as Canadians renewed or initiated higher-rate mortgages.

Slowing increases in food prices, meanwhile, dampened overall CPI growth. Month-over-month, on a seasonally-adjusted basis, prices were up 0.6 per cent in October.

In BC, consumer prices rose 7.8 per cent year-over-year, up from 7.7 per cent last month. Average hourly wages grew 5.6 per cent year-over-year in October, indicating a decline in purchasing power.

October’s CPI numbers continued to suggest that inflation may be slowing. Despite higher gasoline prices, slowing increases in food prices kept the annual rate of change in the CPI stable.

Core inflation, however, remains well above the Bank of Canada‘s 2 per cent target and will need to decline significantly over the next several months before the Bank rethinks its current tightening policy.