@bcrea.bc.ca

OTTAWA – Canadian retail sales decreased 0.3% to $65.7 billion in June. Sales were down in four of nine subsectors and were led by decreases at motor vehicle and parts dealers.

In volume terms, retail sales increased 0.1% in June.

Retail sales were down 0.5% in the second quarter and showed a decrease in seven provinces. In volume terms, quarterly sales declined 0.3%.

Motor Vehicle

The largest decrease in retail sales in June was observed at motor vehicle and parts dealers (-2.1%). The decrease was led by lower sales at new car dealers (-2.9%), followed by used car dealers (-0.6%). The largest increase in the motor vehicle and parts dealers subsector came from other motor vehicle dealers (+2.5%).

Sales at gasoline stations and fuel vendors (-0.5%) were down in June. In volume terms, sales at gasoline stations and fuel vendors increased 2.6%.

Retail Sales

Following a decrease of 1.3% in May, core retail sales were up 0.4% in June on higher sales at food and beverage retailers (+1.2%), which were led by gains at supermarkets and other grocery retailers (except convenience retailers) (+1.8%). Gains at beer, wine and liquor retailers (+0.4%) and specialty food retailers (+0.5%) were offset by lower sales at convenience retailers and vending machine operators (-1.9%).

The largest decrease in core retail sales in June came from sporting goods, hobby, musical instrument, book, and miscellaneous retailers (-0.8%).

E-Commerce

On a seasonally adjusted basis, retail e-commerce sales were down 2.4% to $3.8 billion in June, accounting for 5.7% of total retail trade, compared with 5.8% in May.

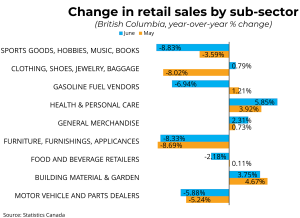

According to the BC Real Estate Association: “Retail sales in British Columbia were nearly unchanged (+0.0043 per cent) in June and fractionally lower (-0.0015 per cent) compared to the same time last year. In the CMA of Vancouver, retail sales were up 0.4 per cent from the prior month and rose 2.6 percent from June 2023.

These statistics from June contribute to an overall weakening national trend in retail sales over the past several months, as characterized by decreased quarterly volume. Overall, this pattern supports the argument for a third rate cut by the Bank of Canada in September to promote more economic activity.”

Source: Statcan & bcrea