BRENDON OGMUNDSON

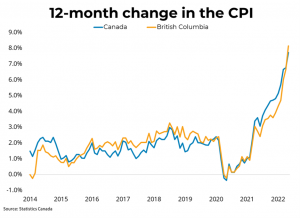

OTTAWA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 7.7 per cent on a year-over-year basis in May, up from 6.8 per cent last month. This was the fastest growth rate since January 1983.

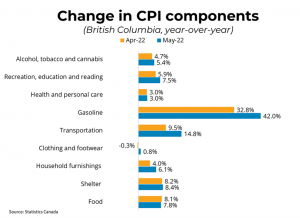

According to Statistics Canada, price rises were broad-based, with groceries up 9.7 per cent year-over-year, gasoline up 48 per cent, and shelter costs up 7.4 per cent. Excluding gasoline, the CPI rose 6.3 per cent year over year in May. Month-over-month, on a seasonally-adjusted basis, prices were up 1.1 per cent, the fastest pace since the introduction of the series in 1992. In BC, consumer prices rose 8.1 per cent year-over-year. Average hourly wages grew 3.9 per cent year-over-year in May, indicating a decline in purchasing power.

A steep trajectory for the overnight rate implies that the 5-year fixed mortgage rate could reach the 5 per cent level for the first time since 2009 while variable mortgage rates may rise to as high as 4.5 per cent. With the stress test for both insured and uninsured borrowers, prospective homebuyers are currently being qualified at a rate of 6.49 per cent with a strong possibility of qualifying at 7 per cent soon, a rate that has not been a reality in the Canadian mortgage market since the early 2000s.

Given how aggressive markets expect the Bank of Canada to be, any good news on inflation, or any significant deterioration in the Canadian economy, could see a significant reversal in the most recent jump in Canadian bond yields. However, the baseline case for now is a Bank of Canada that is single-minded in its pursuit of lower inflation.

Brendon Ogmundson is the Chief Economist with BCREA.