OTTAWA – Canadian home sales fell sharply from January to February, as home buyers remained on the sidelines in the first full month of the ongoing trade war with the United States.

Sales activity recorded over Canadian MLS® Systems dropped 9.8% month-over-month in February 2025, marking the lowest level for home sales since November 2023, and the largest month-over-month decline in activity since May 2022.

“The moment tariffs were first announced on January 20, a gap opened between home sales recorded this year and last. This trend continued to widen throughout February, leading to a significant, but hardly surprising, drop in monthly activity,” said Shaun Cathcart, CREA’s Senior Economist. “This is already being reflected in renewed price softness, particularly in Ontario’s Greater Golden Horseshoe region.”

Declines were broad-based, with sales falling in about three-quarters of all local markets and in almost all large markets. The trend was most pronounced in the Greater Toronto Area and surrounding Great Golden Horseshoe regions.

New listings plunged 12.7% month-over-month, returning all of the surprise surge recorded in January.

With sales and new listings both down by similar magnitudes in February, the national sales-to-new listings ratio edged up slightly to 49.9% compared to 48.3% in January. The long-term average for the national sales-to-new listings ratio is 55%, with readings between 45% and 65% generally consistent with balanced housing market conditions.

There were 146,250 properties listed for sale on all Canadian MLS® Systems at the end of February 2025, up 13.1% from a year earlier but still below the long-term average for that time of the year of around 174,000 listings.

“The uncertainty of the last few weeks seems to be causing some buyers to think twice about big financial decisions right now,” said James Mabey, CREA Chair. “For others, a softer pricing environment and now lower interest rates will be a buying opportunity. If you’re looking to buy or sell a property in 2025, contact a REALTOR® in your area today.”

There were 4.7 months of inventory on a national basis at the end of February 2025, up sharply from 4.1 months at the end of January. The long-term average is five months of inventory. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months and a buyer’s market would be above 6.5 months.

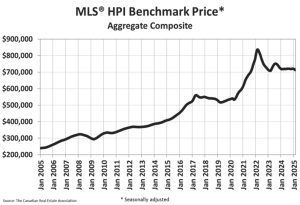

The National Composite MLS® Home Price Index (HPI) declined by 0.8% from January to February 2025, marking the largest month-over-month decrease since December 2023.

The renewed softening in prices was most notable in Ontario’s Greater Golden Horseshoe region.

The non-seasonally adjusted National Composite MLS® HPI was down 1% compared to February 2024.

Source: Canadian Real Estate Association