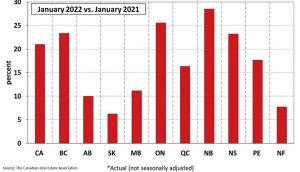

Residential average Price*. Year-over-year percentage change. @CREA

OTTAWA – Despite continued low levels of properties for sale, January 2022 results were still historically high according to the Canadian Real Estate Association (CREA).

Home sales recorded over Canadian MLS® Systems edged up 1 per cent between December 2021 and January 2022. Activity has been generally stable now for four months, running in between the record-highs of last spring and the slowdown posted last summer.

There was an even split between the number of local markets where sales were up and those where sales were down in January, with gains in Calgary, Greater Vancouver and Ottawa offsetting declines in Winnipeg, Montreal, the Fraser Valley and Hamilton-Burlington.

The actual (not seasonally adjusted) number of transactions in January 2022 came in 10.7 per cent below the record for that month, set in 2021. That said, as was the case throughout the second half of 2021, it was still the second-highest level on record for that month.

“As expected, January was pretty quiet on the new listings side of things, with this year’s first big new supply numbers unlikely to emerge until the weather starts to warm up a bit,” said Cliff Stevenson, Chair of CREA. “The question is will that supply be overwhelmed by demand as it was last spring, or will we start to see the re-emergence of some of the many would-be sellers who have been hunkered down for the last two years?”

The number of newly listed homes dropped by 11 per cent month-over-month in January, with a pullback in the GTA accounting for more than half of the national decline.

With sales up a bit and new listings down by double-digits in January, the sales-to-new listings ratio shot to 89.4 per cent compared to 78.7 per cent in December. This was the second-highest level on record for this measure, only slightly below the record 90.2 per cent set last January. The long-term average for the national sales-to-new listings ratio is 55 per cent.

Year-over-year price gains are still in the mid-to-high single digits in Alberta and Saskatchewan, while gains are running at about 13 per cent in Manitoba.

The MLS® HPI provides the best way to gauge price trends because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average home price was a record $748,450 in January 2022, up 21 per cent from the same month last year. The national average price is heavily influenced by sales in Greater Vancouver and the GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from the calculation in January 2022 cuts almost $160,000 from the national average price.

See full report here.