Canadian Home Buyers Face Record Listings Shortage To Begin 2022

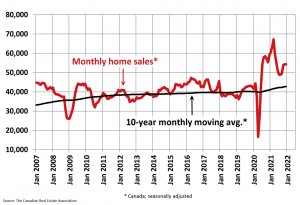

Monthly home sales (CNW Group/Canadian Real Estate Association)

OTTAWA – Statistics released by the Canadian Real Estate Association (CREA) show national home sales remained historically high in December 2021, as the end-of-month supply of properties for sale hit an all-time low.

Home sales recorded over Canadian MLS® Systems were little changed (+0.2 per cent) between November and December 2021. Small gains in November and again in December followed on the heels of a 9 per cent jump in activity in October, placing sales in the final quarter of 2021 between the highs and lows seen earlier in the year.

With the exception of month-over-month sales gains in Calgary and the Fraser Valley, most other large markets mirrored the national trend of little change between November and December.

The actual (not seasonally adjusted) number of transactions in December 2021 came in 9.9 per cent below the record for that month set in 2020. That said, as has been the case throughout the second half of 2021, it was still the second-highest level on record for the month.

On an annual basis, a total of 666,995 residential properties traded hands via Canadian MLS® Systems in 2021. This was a new record by a large margin, surpassing the previous annual record set in 2020 by a little more than 20 per cent, and standing 30 per cent above the average of the last 10 years.

“With the housing supply issues facing the country having only gotten worse to start 2022, take any decline in sales early in the year with a grain of salt because the demand hasn’t gone away, there just won’t be much to buy until a little later in this spring” said Cliff Stevenson, Chair of CREA.

“There are currently fewer properties listed for sale in Canada than at any point on record,” said Shaun Cathcart, CREA’s Senior Economist. “So unfortunately, the housing affordability problem facing the country is likely to get worse before it gets better. Policymakers are starting to say the right things, but now they have to act to change this course we’re on. An aggressive national push to build more homes is what will address the issue, but it will probably have to be a greater amount of building than anything we’ve ever undertaken. A touch over the status quo won’t cut it.”

The number of newly listed homes fell back 3.2 per cent in December compared to November, with declines in Greater Vancouver, Montreal and a number of other areas in Quebec more than offsetting an increase in new supply in the GTA.

With sales little changed and new listings down in December, the sales-to-new listings ratio tightened to 79.7 per cent compared to 77 per cent in November. The long-term average for the national sales-to-new listings ratio is 54.9 per cent.

Almost two-thirds of local markets were sellers’ markets based on the sales-to-new listings ratio being more than one standard deviation above its long-term mean in December 2021. The remaining one-third of local markets were in balanced market territory.

There were just 1.6 months of inventory on a national basis at the end of December 2021 — the lowest level ever recorded. The long-term average for this measure is a little more than 5 months.

In line with the tightest market conditions ever recorded, the Aggregate Composite MLS® Home Price Index (MLS® HPI) was up another 2.5 per cent on a month-over-month basis in December 2021.

The non-seasonally adjusted Aggregate Composite MLS® HPI was up by a record 26.6 per cent on a year-over-year basis in December.

Looking across the country, year-over-year price growth has crept back above 25 per cent in BC, though it remains lower in Vancouver, close to on par with the provincial number in Victoria, and higher in other parts of the province.

Year-over-year price gains are still in the mid-to-high single digits in Alberta and Saskatchewan, while gains are running at about 12 per cent in Manitoba.

Ontario saw year-over-year price growth remain above 30 per cent in December, with the GTA continuing to surge ahead after trailing other parts of the province for most of the pandemic.

Greater Montreal’s year-over-year price growth remains at a little over 20 per cent, while Quebec City was only about half that.

Price growth is running above 30 per cent in New Brunswick (higher in Greater Moncton, lower in Fredericton and Saint John), while Newfoundland and Labrador is now at 11 per cent year-over-year.

The MLS® HPI provides the best way to gauge price trends because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average home price was $713,500 in December 2021, up 17.7 per cent from the same month last year. The national average price is heavily influenced by sales in Greater Vancouver and the GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from the calculation in December 2021 cuts more than $150,000 from the national average price.

Further information can be found at http://crea.ca/statistics.