BRITISH COLUMBIA – Canadian real GDP was largely unchanged in December, declining by 0.02 per cent, following two months of growth. Goods-producing sectors contracted by 0.2 per cent, while services were essentially unchanged. Construction activity fell 0.6 per cent in December, with residential building declining by 1.6 per cent.

Offices of real estate agents and brokers rose 9 per cent, following five consecutive monthly declines amid soft home sales. Preliminary estimates suggest that output in the Canadian economy rose 0.4 per cent in January, helped by the conclusion of strikes in Quebec.

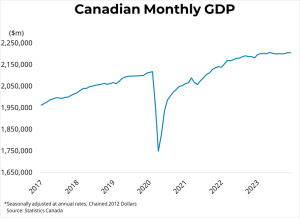

Real GDP rose 0.2 per cent in the fourth quarter, close to 1 per cent on an annualized basis, erasing a 0.1 per cent decline in the third quarter. Improved net exports, driven by the strong US economy and Albertan crude oil, pushed GDP upwards. However, business investment declined for the sixth time over the most recent seven quarters.

Household spending rose 0.2 per cent in the fourth quarter, driven by vehicle imports, but strong population growth meant that per capita consumption declined for the third consecutive quarter. At 6.2 per cent, the household savings rate was down slightly from the third quarter, but remains higher than pre-pandemic levels. Housing investment was down for the year, with residential construction down 10.2 per cent and ownership transfer costs down 7.7 per cent. At 1.2 per cent growth, 2023 was the slowest year for real GDP growth since 2016, excluding 2020.

Economic growth in Canada was soft in 2023, and although it flirted with recession it has so far managed to avoid one. The central bank has raised rates by 475 basis points over two years and, as of the most recent data, managed to bring inflation down to 2.9 per cent without causing a major increase in unemployment or a contraction in GDP. The “soft landing” that seemed unlikely two years ago is now visible.

However, while aggregate real GDP has not contracted, per capita GDP has contracted for six consecutive quarters as economic growth has failed to keep pace with rapid population growth. Per capita, real GDP is comparable to the level of 2017. Financial markets continue to expect that rate cuts will begin in the late spring and accumulate into the summer. The next rate announcement is on next Wednesday, March 6th.