BRITISH COLUMBIA – The Canadian economy contracted in the second quarter with output falling 1.1 per cent on an annualized basis.

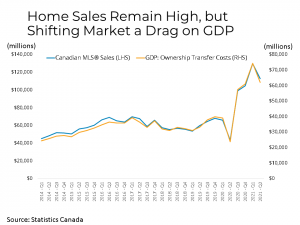

That decline follows three prior quarters of very strong growth. Most of the decline in real GDP was driven by slowing home sales and lower exports. After rising to record levels, home sales activity across the country have moderated.

However, the downshift from record activity to lower, but still strong sales was significant enough to negatively impact economic growth. That shift in the housing market was compounded by lower exports, which fell 4 per cent largely due to supply chain disruptions, as well as flat household spending due to COVID-19 restrictions put in place in the second quarter in large eastern provinces.

Household incomes grew 2.2 per cent in the second quarter, well outpacing just 0.7 per cent growth in spending. As a result, the Canadian savings rate remains in double digits for the fifth straight quarter. The eventual spending of at least some of the accumulated savings across the Canadian economy will be a key determinant of how the recovery unfolds from here.

Most of the factors that led to a decline in GDP over the second quarter were either one-time changes or due to what should be temporary supply chain disruptions. Early data for June is showing strong growth, but the pace of the recovery remains uncertain due to the pandemic and especially the Delta variant driven rise in cases around the country.

While Inflation continues to run ahead of the Bank of Canada‘s 2 per cent target, the fourth-wave of COVID-19 cases is inserting a significant amount of uncertainty into the outlook and may cause a delay in the Bank of Canada’s plans, pushing monetary tightening further into 2023.