BRITISH COLUMBIA – The Canadian economy expanded at a 9.6 per cent annual rate in the fourth quarter of 2020.

Growth was led by increased government spending, business investment and investment in new home construction and renovations as well as a large change in business inventories as large drawdowns of inventory from previous quarters reversed.

Growth was led by increased government spending, business investment and investment in new home construction and renovations as well as a large change in business inventories as large drawdowns of inventory from previous quarters reversed.

For 2020 as a whole, the Canadian economy shrank 5.4 per cent, the steepest decline since quarterly GDP data were first recorded in 1961. Interestingly, the households savings rate registered 12.7 per cent, the third consecutive quarter of double digit saving rate.

Remarkably, total household savings in 2020 matched the cumulative savings of the previous seven years combined. That accumulated savings, and how it gets spent over the next year, will be a key component of what we expect to be a robust economic recovery in 2021.

Following an unprecedented 2020, we expect the Canadian economy will enjoy two years of very strong growth with the economy expanding by 5 per cent this year and a 4.3 per cent in 2022. An expected acceleration of vaccinations appears to be on the immediate horizon. As that roll-out progresses, we expect pent-up spending throughout the economy to be unleashed, driving a strong economic recovery.

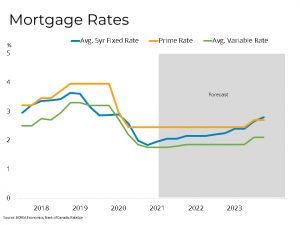

While the Bank of Canada has not changed its commitment to keeping its overnight rate unchanged until 2023, there has been substantial upward pressure on long-term Canadian interest rates as markets price in a faster than expected recovery along with the impact of the $1.9 trillion US COVID-19 relief package.

As 5-year government bond yields move higher, 5-year fixed mortgage rates have also started to rise from a record low average of 1.8 per cent to a still very low level of 1.95 per cent. For context, the average 5-year fixed rate prior to the onset of the COVID-19 pandemic was about 2.9 per cent.