BRITISH COLUMBIA – Prior to the US presidential election, the outlook for Canadian mortgage rates seemed relatively clear. The Bank of Canada’s overnight policy rate was on a glide path to reach 2.75 per cent in early 2025 and fixed mortgage rates seemed likely to settle in a range of 4.5 to 4.75 per cent. Now, with the election of Donald Trump and his somewhat stochastic approach to policy announcements, the outlook has become far murkier.

BRITISH COLUMBIA – Prior to the US presidential election, the outlook for Canadian mortgage rates seemed relatively clear. The Bank of Canada’s overnight policy rate was on a glide path to reach 2.75 per cent in early 2025 and fixed mortgage rates seemed likely to settle in a range of 4.5 to 4.75 per cent. Now, with the election of Donald Trump and his somewhat stochastic approach to policy announcements, the outlook has become far murkier.

Markets are still processing the potential impacts of a new Trump administration. The initial verdict from bond markets was that the proposed policies, mainly the extension of tax cuts, would produce higher growth and inflation. Bond yields jumped in the post-election period. The Canadian five-year bond yield rose as high as 3.32 per cent, prompting a modest uptick in fixed mortgage rates, before cratering back to pre-election levels at the start of December. Clearly, the bond market is as uncertain as anyone about the future of policy and the economy.

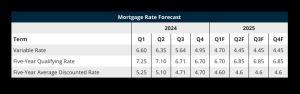

Where mortgage rates go from here depends on how serious the Trump administration is about its campaign promises and subsequent announcements, namely threats of punitively high tariffs on Canadian imports. For now, and until trade policy is more concretely known, our baseline forecast assumes a status quo for 2025, with a variable rate of 4.45 per cent and a five-year fixed mortgage rate of 4.6 per cent.

Economic Outlook

The Canadian economy appears to have pulled off a soft landing, with GDP growth slowing but not dipping into recession territory. That said, growth has been falling short of the Bank of Canada’s forecast over the second half of the year and Canadian GDP per capita continues to struggle amidst rapid population growth and an uptick in the unemployment rate. This comes in the context of inflation moderating towards the midpoint of its target range, with price appreciation being largely driven by high shelter costs.

While falling interest rates should provide a boost to growth over the next year, any recovery will be upended if the Canadian economy is forced to deal with 10 to 25 per cent tariffs on its exports to the US. While a 10 per cent tariff would be a challenge for the economy, a 25 per cent tariff would almost certainly cause a recession. What’s more, the impacts on inflation will depend on whether Canada responds with its own tariffs on American goods. Our estimates show a loss of real GDP ranging from 1 to 5.5 per cent compared to a no-tariff baseline.

Bank of Canada Outlook

With both the economy and inflation undershooting the Bank’s expectations, policymakers appear eager to get the economy back on a path to recovery, particularly with risks looming large in 2025. After two “jumbo” 50-basis-point cuts, the Bank has now lowered its overnight to the top end of what it considers “neutral” for the economy. However, considering the recent trajectory of real GDP growth, it will likely have to continue cutting. We anticipate that for now, the Bank will cut to either 2.5 or 2.75 per cent early in 2025 and then pause to assess the state of the economy and the need for further stimulus.

Of course, like everything else about the outlook for 2025, the path of interest rates will depend on the potential imposition and level of tariffs. While a 25 per cent tariff would likely prompt the Bank of Canada to lower its policy rate below 2 per cent, there is also a scenario where Canada matches the 25 per cent tariff, causing a spike in Canadian import prices and inflation, which the Bank may or may not choose to look past.

Until we have better clarity on the direction of trade policy, we expect there to be more volatility in bond markets as investors look for meaning in each new communication from the incoming administration.

Source: bcrea.bc.ca