BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.3 per cent on a year-over-year basis in March, down from a 2.6 per cent increase in February. Month-over-month, on a seasonally adjusted basis, the CPI was unchanged in March.

The overall slowdown in headline CPI is largely driven by lower gasoline prices, with the CPI ex-gasoline rising by 2.5 per cent in March. Shelter price growth continues to cool, as mortgage interest costs were up 7.9 per cent, marking the nineteenth consecutive month of deceleration.

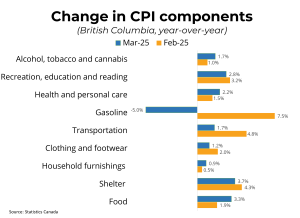

Similarly, rent was up 5.1 per cent year-over-year in March, down from 5.8 per cent in February. In BC, consumer prices rose 2.6 per cent year-over-year, down from 3.0 per cent in February.

The Bank of Canada’s preferred measures of median and trimmed inflation, which strip out volatile components, are at 2.9 per cent and 2.8 per cent year-over-year, respectively.

After a sharp uptick in February, March’s CPI report saw headline inflation moderate towards the neutral range of 2.0 per cent. However, the Bank’s core measures of inflation continue to linger near the ceiling of their target range, suggesting some underlying upward pressure in prices.Nonetheless, markets remain uncertain about the Bank’s decision on Wednesday as Canada braces for the inflationary impacts of tariffs.

SOURCE: bcrea.bc.ca