BRITISH COLUMBIA – The British Columbia Real Estate Association released a report stating that Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.3 per cent on a year-over-year basis in March, a decrease from the 5.2 per cent rate in February.

BRITISH COLUMBIA – The British Columbia Real Estate Association released a report stating that Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.3 per cent on a year-over-year basis in March, a decrease from the 5.2 per cent rate in February.

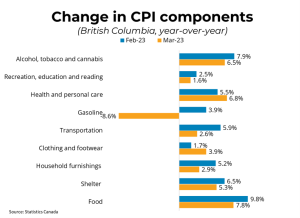

This large drop was mostly due to base year effects; the CPI was rising quickly this month last year and fuel prices in particular are substantially down from a year ago. Grocery prices continue to rise quickly, up 9.7 per cent from last year, following seven consecutive months of double-digit increases. Mortgage interest costs were up 26.4 per cent year-over-year, the fastest pace on record, as Canadians renewed or initiated higher-rate mortgages.

In contrast, the Homeowner’s Replacement Cost, which tracks home prices, continued to slow, increasing 1.7 per cent year-over-year in March, down from 3.3 per cent in February. Month-over-month, on a seasonally-adjusted basis, prices were up 0.1 per cent in March. In BC, consumer prices rose 4.7 per cent year-over-year.

There continue to be encouraging signs that the bout of rapid price appreciation that began in February of last year is waning. Although food prices and mortgage interest costs continue to rise quickly, most other categories in the index are trending back toward normal price trends.

Indeed, excluding mortgage costs, the year-over-year change in CPI was just 3.6 per cent. The Bank of Canada‘s measures of core inflation, which strip out volatile components, each ticked downwards for a fourth month in a row. The three-month annualized change in seasonally-adjusted CPI is now well within the bank’s 1-3 per cent target range, hitting 2.1 per cent in March.

Still, although year-over-year price appreciation may be moderating, at 4.3 per cent it is still well above the Bank of Canada’s 2 per cent target. While the Bank of Canada held the overnight rate steady at 4.5 per cent for a second consecutive meeting in April, the Bank could change course if inflation does not continue to cool or if the economy dips toward recession.

@bccrea.bc.ca

Business Examiner Submitted