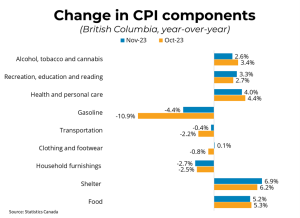

BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 3.1 per cent on a year-over-year basis in November, unchanged from the rate in October. Excluding energy costs, CPI rose 3.8 per cent year-over-year in November. Shelter costs continue to be a major driver of inflation, with mortgage interest costs up 29.8 per cent and rent up 7.4 per cent.

Grocery price inflation continued to moderate, but nevertheless increased 4.7 per cent year-over-year last month. Month over month, seasonally adjusted CPI rose 0.25 per cent. In BC, consumer prices rose 3.2 per cent year-over-year. The Bank of Canada‘s preferred measures of core inflation, which strip out volatile components, remained around 3.5 per cent year-over-year in November.

After considerable progress in taming inflation, the rate of change in the CPI has stubbornly remained close to the 3-4 per cent range since the late spring. Alongside softening labour markets and weak GDP growth, inflation in this territory has been sufficient to keep the Bank of Canada from raising rates since the summer.

Although softer gasoline prices have done some of the work to pull down the inflation rate, large increases in mortgage interest costs, which are a direct consequence of Bank tightening, have pulled inflation upwards. Indeed, inflation excluding mortgage interest costs was unchanged from last month at just 2.2 per cent.

Taken together, markets expect that the Bank of Canada is unlikely to raise rates further. Rather, markets expect the Bank to cut rates substantially by the summer of 2024, but this will of course depend on the rate of economic growth and price appreciation in the first half of the year.

Source: bcrea