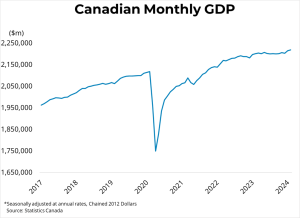

BRITISH COLUMBIA – Canadian real GDP grew 0.2 per cent in February, following a 0.5 per cent increase in January.

BRITISH COLUMBIA – Canadian real GDP grew 0.2 per cent in February, following a 0.5 per cent increase in January.

The growth was driven by services-producing sectors (+0.2 per cent), led by growth in rail, air, and pipeline transportation. Residential construction activity fell by 0.5 per cent, declining for the fourth consecutive month following a burst of activity in the summer and fall of 2023.

Cooler home sales caused GDP from offices of real estate agents and brokers to fall 1.9 per cent last month, undoing some of the growth in December and January. Preliminary estimates suggest that output in the Canadian economy was essentially unchanged in March.

Amid cooling inflation and weakening labour markets, February’s rather soft GDP report provides additional support for the broadly anticipated beginning of rate cuts in June. Although growth appeared strong in January, this was largely due to the conclusion of public sector strikes in Quebec, which caused a temporary boost to growth.

Meanwhile, February’s growth came in cooler than expected and the preliminary estimate for March is for zero growth. Markets currently expect the Bank to make its first overnight rate cut since early 2020 at its next meeting on June 5th.

Source: bcrea.bc.ca