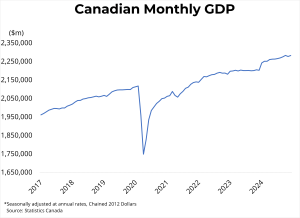

BRITISH COLUMBIA – Canadian real GDP rose by 0.2 per cent in December, after declining by 0.2 per cent in November.

Goods-producing sectors rose 0.3 per cent, while service-producing industries were up 0.2 per cent. Sectoral growth was led by mining, quarrying, and oil and gas extraction (0.8 per cent), utilities (4.7 per cent), and retail trade (2.6 per cent). Output for the offices of real-estate agents and brokers fell by 6.0 per cent month-over-month. Preliminary estimates suggest that real GDP by industry increased by 0.3 per cent in January.

Real GDP increased by 0.6 per cent in the final quarter of 2024, registering an annualized growth rate of 2.6 per cent. Household spending grew by 1.4 per cent, leading to a 1.0 per cent increase in per capita household expenditures during the fourth quarter. Growth was also driven by strong residential construction (3.9 per cent) and non-residential business investment (0.7 per cent).

Canadian trade grew in the fourth quarter, with exports of goods and services (1.8 per cent) outpacing imports (1.3 per cent). Household savings rates fell from 7.3 per cent to 6.1 per cent in the fourth quarter, driven by slower wage and income growth compared to spending, as well as lower investment earnings. On a per capita basis, GDP rose 0.2 per cent in Q4, but fell 1.4 per cent in 2024 overall.

Canada’s GDP growth in the final quarter reflects the impacts of lower interest rates as well as temporary relief from the GST holiday on household consumption. This comes in the context of inflation moderating to its target range, with price appreciation being largely driven by high shelter costs. In addition, uncertainty surrounding potential tariffs and their inflationary impacts continue to hamper our economic outlook.

This report, although stronger than expected, likely will not sway the Bank in either direction particularly as the impact of likely tariffs takes center stage before the next Bank of Canada interest rate decision.

Source: bcrea.bc.ca