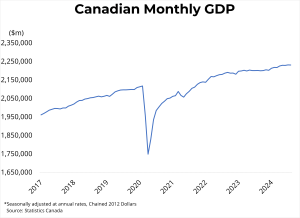

BRITISH COLUMBIA – Canadian real GDP was essentially unchanged in August, following a 0.1 per cent increase in July. Service-producing industries grew by 0.1 per cent, while goods-producing industries fell by 0.4 per cent, reaching their lowest level since December 2021.

Manufacturing was the largest detractor from growth for August, driven by both durable (-1.0 per cent) and non-durable goods (-1.4 per cent). The public sector saw its eighth consecutive month of growth (0.2 per cent), while utilities contracted by 1.9 per cent after three consecutive months of growth.

Retail trade rose for the second month in a row by 0.6 per cent, while mining, quarrying, and oil and gas extraction (+0.6 per cent), and finance and insurance (+0.5 per cent) also contributed to growth. Rail lockouts resulted in a 7.7 per cent decline in rail transportation, causing a 0.3 per cent decline in the overall transportation and warehousing sector for August.

Finally, GDP for real-estate offices and agents was up 0.7 points month-over-month. Preliminary estimates suggest that real GDP grew by 0.3 per cent in September, contributing to a 0.2 per cent estimate for GDP growth in the third quarter of 2024.

Despite exhibiting growth in 12 of 20 overall industries, the Canadian economy remained at virtually the same level of output compared to July. These findings further justify the Bank of Canada‘s decision to cut the overnight rate by 50 basis points earlier this month.

However, a strong preliminary estimate for September suggests a potentially stronger economy in the final quarter of 2024 amidst the Bank’s cutting cycle. Steady, positive monthly growth, accompanied by headline CPI settling around its 2% target range, would suggest a return to a more gradual pace of rate cuts by the Bank of Canada, though the door remains open to more aggressive moves if October inflation and jobs data show continued weakness.

Source: bcrea.bc.ca