BRITISH COLUMBIA – The BC Real Estate Association has released their Canadian Inflation Report for August 2022 showing Canadian prices, as measured by the Consumer Price Index (CPI), rose 7 per cent on a year-over-year basis in August, down from 7.6 per cent last month.

BRITISH COLUMBIA – The BC Real Estate Association has released their Canadian Inflation Report for August 2022 showing Canadian prices, as measured by the Consumer Price Index (CPI), rose 7 per cent on a year-over-year basis in August, down from 7.6 per cent last month.

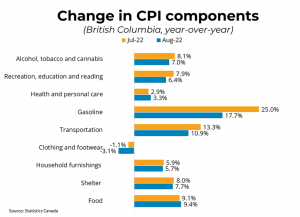

This was the second consecutive month of decelerating price growth driven primarily by declining gasoline prices. Excluding gasoline, the CPI rose 6.3 per cent year over year in August, down from 6.6 per cent in July. This reduced pace of price appreciation was driven by slowing increases in the price of transportation (+10.3 per cent) and shelter (+6.6 per cent), although grocery prices rose quickly (+11.9 per cent).

Month-over-month, on a seasonally-adjusted basis, prices were up 0.1 per cent, the slowest rate since December 2020. In BC, consumer prices rose 7.3 per cent year-over-year, down from 8 per cent last month. Average hourly wages grew 5.4 per cent year-over-year in August, indicating a decline in purchasing power.

August’s CPI numbers continued to provide encouraging signs that inflation may be slowing. The latest data show declines not just driven by falling gas prices, but a softening in the rate of appreciation in core inflation including transport and shelter.

However, markets will want to see sustained declines in the rate of inflation over the next several months before mortgage rates decline significantly. Bond yields are continuing to trend upwards, meaning that markets are still expecting an aggressive Bank of Canada singularly focused on bringing inflation back to its 2 per cent target.

See full report here