Source: bcrea.bc.ca

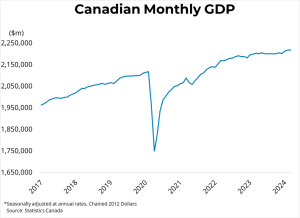

BRITISH COLUMBIA – Canadian real GDP was essentially unchanged in March, following a 0.2 per cent increase in February.

Both goods and services sectors were unchanged from February. Residential construction activity rose by 1.4 per cent driven by increased construction of single-detached homes, while the broader construction sector also rose (+1.1 per cent). GDP from offices of real estate agents and brokers fell 0.9 per cent last month as home sales cooled somewhat. Preliminary estimates suggest that output in the Canadian economy rose by 0.3 per cent in April.

Real GDP rose 1.7 per cent in the first quarter on an annualized basis, following no growth in the fourth quarter of 2023 (revised down from 0.2 per cent).

Household spending on services, such as telecom, rents, and air travel, rose by 1.1 per cent from the prior quarter and drove much of the increase. Employee compensation rose 1.5 per cent in the first quarter, following a 0.9 per cent increase in the previous quarter. This helped contribute to a rising household savings rate, which hit 7 per cent, the highest rate since the first quarter of 2022. Meanwhile, housing market resale activity rose, with ownership transfer costs up 7.1 per cent. New home construction was essentially flat.

Zero real economic growth in March, and below-forecast first quarter growth, is yet another piece of evidence supporting a rate cut next week. Soft real GDP growth in Canada looks worse when one considers the very rapid rate of population growth; real GDP per capita continues to sharply decline. This comes in the context of excellent progress on inflation, which hit 2.7 per cent last month, and looks even better when one digs deeper into the CPI report.

Price appreciation now boils down almost entirely to rents and mortgage costs. Employment, for its part, also continues to soften, with the unemployment rate hitting 6.1 per cent last month. Taken together, markets anticipate that the bank will begin rate cuts at its announcement next week on June 5th.

Source: bcrea.bc.ca