BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.8 per cent on a year-over-year basis in February, down from a 2.9% increase in January according the BC Real Estate Association’s recent release.

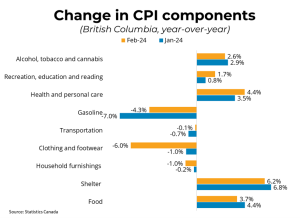

Month-over-month, on a seasonally adjusted basis, CPI rose by 0.1 per cent in February. Excluding energy costs, CPI rose 2.9 per cent year-over-year in February, down from 3.2 per cent in January. Decelerating food costs also contributed to the slowing in the CPI, with prices of food purchased from stores rising by 2.4 per cent in February compared to 3.4 per cent in January.

Shelter costs, however, continue to be a major driver of inflation, with mortgage interest costs up 26.3 per cent and rent up 8.2 per cent from the same time last year in February. Excluding shelter, consumer prices rose just 1.3 per cent, year over year. In BC, consumer prices rose 2.6 per cent year-over-year.

The Bank of Canada’s preferred measures of core inflation, which strip out volatile components, fell to between 3.1 and 3.2 per cent per cent year-over-year in February.

January’s CPI report contained a second month unexpectedly good news. Canada’s annual change in prices has now remained for two consecutive months within the Bank of Canada’s 1 to 3 per cent target range. The last time this occurred was in early 2021. Despite a 4 per cent jump in gas prices, the CPI eased due to slowing price appreciation in other areas of the economy.

Food price appreciation has been easing over the past 12 months and is now not far above historical norms, while other CPI components including cellular services have declined in price from last year. The category that remains the most challenging is shelter. Although the appreciation in mortgage costs looks to have peaked, rents in particular so far showing little sign of slowing.

Overall, February was another encouraging report, and markets shifted their expectations of rate cuts forward slightly, with the odds of a cut in June increasing. However, the change in CPI will need to continue demonstrating a sustained trend towards 2 per cent over the spring before the Bank of Canada is comfortable cutting rates.

Source: bcrea.bc.ca/