BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.8 per cent on a year-over-year basis in December, up from 4.7 per cent in November. On a month-over-month basis, the CPI declined 0.1 per cent in December, the first monthly decline since December 2020. The Bank of Canada‘s preferred measures of core inflation (which use techniques to strip out volatile elements) rose an average of 2.9 per cent year-over-year in December. Higher prices for food (+5.2 per cent), passenger vehicles (+7.2 per cent) and homeowners’ home and mortgage insurance (+9.3 per cent) were major drivers of growth in the headline CPI.

Supply-chain difficulties continued contributing to price gains, as well as the flooding and infrastructure damage in BC. In BC, consumer prices were essentially flat month-over-month, and up 3.9 per cent on a year-over-year basis.

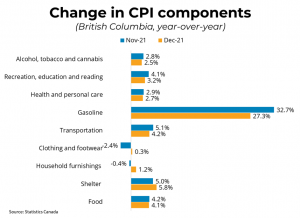

Inflation continues to run ahead of the Bank of Canada’s 2 per cent target. Although transportation costs appear to be trending down, food and shelter costs are on the rise. While the food prices may reflect temporary supply chain issues, a recovery in Canadian rents and rising mortgage costs mean the shelter component of CPI may continue to rise in 2022.

As a result, we expect this elevated level of inflation to persist through 2022 before prices begin moderating. The Bank of Canada has signaled that it will begin raising its policy rate this year, and markets are now expecting those rate increases to happen much earlier than previously anticipated, perhaps as early as the Bank of Canada meeting next week.