KELOWNA – Residential sales in the Okanagan continue to be brisk, with sales of 1263 units posted to the Multiple Listing Service (MLS®) in June, up 38% from June of last year reports the Okanagan Mainline Real Estate Board (OMREB).

“Housing demand continues to be robust in all three regions we serve. While days to sell rose slightly in June to 81 days from 77 in May, consumers looking to buy are still likely to feel pressure to respond quickly and decisively to listings”, says Anthony Bastiaanssen, OMREB President and active REALTOR® in the central Okanagan, noting that the advice and guidance of a real estate professional can really make a difference in these challenging market conditions.

He notes that the average MLS® residential price this past month was $475,091, slightly down from $486,636 in May and representing a 16 % increase over the same month last year. In all regions served by OMREB, active listings dropped 21.37% compared to this time last year.

“We are seeing more buyers looking to regions outside the core in order to find homes in line with their budget. Average residential pricing that is slightly down from May could be an indication of this, reflecting a higher proportion of lower-priced sales in the make-up of product sold in this time period,” comments Bastiaanssen. “Either way, we are still light on supply as compared to demand, so until this situation eases, we will see higher prices.”

Population growth is a factor impacting the current Okanagan market, with most buyers coming from the Lower Mainland, and other regions of BC, followed by buyers from Alberta and other provinces. However, an OMREB monthly survey of buyers shows that a significant majority of buyers are Okanagan residents at 58%, followed by 17% from the Lower Mainland or Vancouver Island, and 12% from Alberta.

“Of the 58% of buyers who already live in the Okanagan, there’s a relative balance between first time buyers, and those who are upgrading, downsizing, or moving to another similar-type property,” says Bastiaanssen. “Comparatively, those buying to invest, at 13% of the total buyer population, are a relatively small percentage.”

He also notes that two parent families with children, at 28% of buyers, make up the largest single group of buyers, followed by empty nesters or retired individuals at 21% and couples without children at 18%. In terms of housing affordability, Bastiaanssen would like to see a move towards more of a balanced market.

“Currently, we are short of listings in many neighborhoods and across most home types for the number of buyers who wish to buy. This drives prices up, reducing affordability. A more optimal situation is where there is more of a balance between supply and demand.”

Local builders are responding to the situation with the number of housing starts on a significant rise, but the time it takes to bring new product to market means that the current situation is likely to remain for some time.

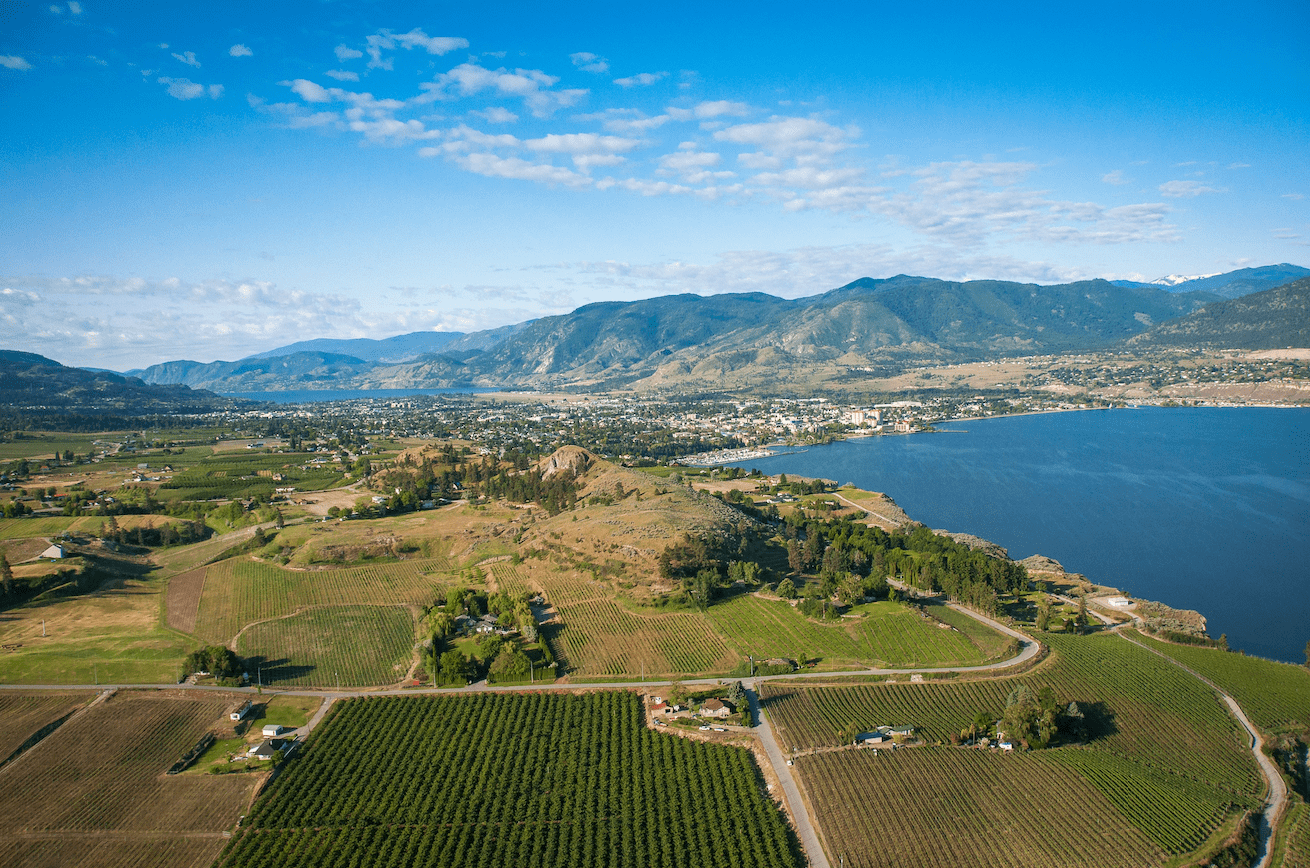

– OMREB serves three diverse markets within the region: the Central Okanagan Zone (Peachland to Lake Country), the North Zone (Predator Ridge to Enderby) and the Shuswap- Revelstoke Zone (Salmon Arm to Revelstoke). For comprehensive Board-wide statistical information, please visit www.omreb.com.