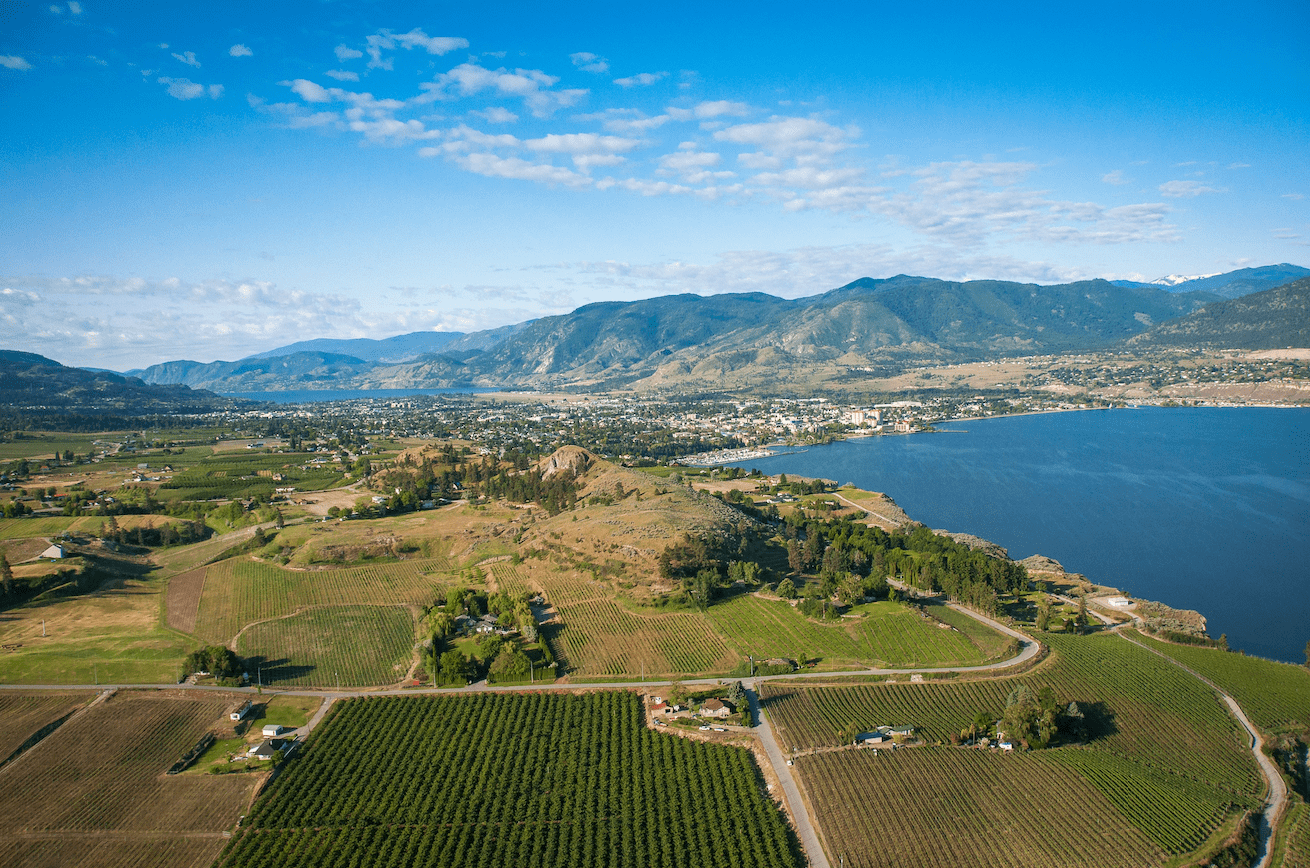

KELOWNA — Owners of nearly 289,000 properties throughout the Thompson Okanagan will receive their 2023 assessment notices, which reflect market value as of July 1, 2022.

KELOWNA — Owners of nearly 289,000 properties throughout the Thompson Okanagan will receive their 2023 assessment notices, which reflect market value as of July 1, 2022.

“Homeowners throughout the Okanagan can generally expect to receive assessments that are up about 10 per cent to 15 per cent for houses while condos and townhomes are up a bit higher,” says Okanagan area Deputy Assessor Tracy Wall. “Assessments are valued as of July 1, meaning everyone’s annual assessment is a reflection of what your home could have sold for around that time.”

“Home assessments for Kamloops and the surrounding area are rising about 10 per cent to 15 per cent for most communities whereas some communities will be notably higher,” adds Thompson area Assessor Tracy Shymko. “It is important to think about your assessment as what you could have sold your home for around July 1 of the past year and not necessarily in today’s real estate market.”

As BC’s provider of property assessment information, BC Assessment collects, monitors and analyzes property data throughout the year.

Overall, the Thompson Okanagan’s total assessments increased from $203.7 billion in 2022 to $234.3 billion this year. A total of about $3.8 billion of the region’s updated assessments is from new construction, subdivisions and the rezoning of properties. BC Assessment’s Thompson Okanagan region includes the urban centres of Kelowna and Kamloops as well as all surrounding Okanagan and Thompson communities as listed below.

The summaries below provide estimates of typical 2022 versus 2023 assessed values of properties throughout the region.

These examples demonstrate market trends for single-family residential properties by geographic area:*

| Single Family Home Changes by Community | 2022 Typical Assessed Value

as of July 1, 2021 |

2023 Typical Assessed Value

as of July 1, 2022 |

%

Change |

| City of Kelowna | $869,000 | $988,000 | +14% |

| West Kelowna | $855,000 | $964,000 | +13% |

| Lake Country | $886,000 | $972,000 | +10% |

| Penticton | $637,000 | $727,000 | +14% |

| Summerland | $694,000 | $790,000 | +14% |

| Keremeos | $449,000 | $505,000 | +12% |

| Oliver | $555,000 | $610,000 | +10% |

| Osoyoos | $601,000 | $685,000 | +14% |

| Princeton | $338,000 | $389,000 | +15% |

| Peachland | $820,000 | $890,000 | +9% |

| Armstrong | $578,000 | $663,000 | +15% |

| Enderby | $467,000 | $538,000 | +15% |

| Vernon | $644,000 | $714,000 | +11% |

| Coldstream | $816,000 | $887,000 | +9% |

| Salmon Arm | $573,000 | $668,000 | +17% |

| Spallumcheen | $521,000 | $586,000 | +12% |

| Sicamous | $449,000 | $492,000 | +9% |

| Lumby | $502,000 | $568,000 | +13% |

| City of Kamloops | $619,000 | $689,000 | +11% |

| Barriere | $355,000 | $428,000 | +21% |

| Clearwater | $346,000 | $445,000 | +29% |

| Merritt | $416,000 | $475,000 | +14% |

| Ashcroft | $367,000 | $422,000 | +15% |

| Cache Creek | $285,000 | $324,000 | +14% |

| Chase | $426,000 | $507,000 | +19% |

| Clinton | $176,000 | $248,000 | +41% |

| Logan Lake | $402,000 | $445,000 | +11% |

| Lillooet | $346,000 | $390,000 | +13% |

| Sun Peaks | $1,146,000 | $1,647,000 | +44% |

*All data calculated based on median values.

These examples demonstrate market trends for strata residential properties (e.g. condos/townhouses) by geographic area for select urban communities:*

| Strata Home Changes (Condos/Townhouses)

By Community |

2022 Typical Assessed Value

as of July 1, 2021 |

2023 Typical Assessed Value

as of July 1, 2022 |

%

Change |

| Kelowna | $446,000 | $519,000 | +16% |

| West Kelowna | $467,000 | $547,000 | +17% |

| Penticton | $349,000 | $414,000 | +19% |

| Vernon | $349,000 | $399,000 | +14% |

| Kamloops | $344,000 | $408,000 | +19% |

| Sun Peaks | $685,000 | $758,000 | +11% |

*All data calculated based on median values.

BC Assessment’s website at bcassessment.ca includes more details about 2023 assessments, property information and trends such as lists of 2023’s top valued residential properties across the province.

The website also provides self-service access to a free, online property assessment search service that allows anyone to search, check and compare 2023 property assessments for anywhere in the province. Property owners can unlock additional property search features by registering for a free BC Assessment custom account to check a property’s 10-year value history, store/access favourites, create comparisons, monitor neighbourhood sales, and use our interactive map.

“Property owners can find a lot of valuable information on our website including answers to many assessment-related questions, but those who feel that their property assessment does not reflect market value as of July 1, 2022 or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January,” says Tracy Wall.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by January 31st, for an independent review by a Property Assessment Review Panel,” adds Wall.

The Property Assessment Review Panels, independent of BC Assessment, are appointed annually by the provincial government, and typically meet between February 1 and March 15 to hear formal complaints.

“It is important to understand that increases in property assessments do not automatically translate into a corresponding increase in property taxes,” explains Tracy Shymko. “As noted on your Assessment Notice, how your assessment changes relative to the average change in your community is what may affect your property taxes.”