RUSS TAYLOR

As seen in Truck LoggerBC Fall 2024

OTTAWA – At the end of August, there continues to be general gloom in global wood products markets. Many European countries continue to be squeezed between rising log costs and flat to declining lumber prices. China is over-supplied and imported log and lumber prices have generally been low. Japan’s market is also weak, but Europeans must now ship containers around Africa to get to Asia due to the Red Sea shipping crisis, making exports more expensive. Temporary advantage: North America.

Aside from disruptions from political wars (Russia-Ukraine, Israel-Hamas, and now other countries), a looming unknown is the potential impact from the European Union’s deforestation regulation (EUDR). If this policy requirement is implemented as currently planned on December 30, 2024, it will cause total trade chaos in world markets.

Simply put, many countries will not be ready to meet the stringent requirements of the policy, and many countries including China and India are declining, at least at this point, to participate for national security reasons. While the markets may be lacklustre for the rest of 2024, the EUDR could quickly change it all with the potential of huge dislocations in global trade flows.

US market improving

This year, the US Federal Reserve has not yet implemented any prime rate reductions as compared to the three to even four reductions forecast to occur earlier in the year by many economists. The good news is that it is widely expected that the Fed’s first prime rate reduction will occur in mid-September, with the possibility of two more reductions by the end of the year. This should start a steady reduction in interest rates for homebuyers and renovators for the rest of this year with more relief to follow in 2025. Since June, the Bank of Canada has implemented three 25 basis point reductions in its prime interest rate, and more are expected in 2024. This will be good news for the lumber and panel industry that has been waiting for rising lumber demand, especially as new residential construction and repair/remodelling ac-count for 75 per cent of US lumber consumption, and even more in Canada.

In July, US lumber prices bottomed out when they became very depressed from declining demand and over-production, with prices being well below sawmill costs. On July 12, W-SPF 2×4 #2&Better, lumber prices bottomed out at US$325/Mbf (FOB BC mill) and in early September had jumped to US$392/Mbf. In late April/early May, Southern Yellow Pine (West) bottomed out at US$285/Mbf (FOB mill) and by early September had increased to US$334/Mbf. In both cases, these current prices are still near or below the mills’ breakeven prices.

Dismal sawmill operating results

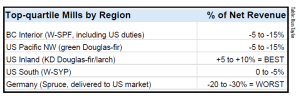

A quick proforma analysis on the lumber revenue versus the costs of lumber production of four major producing regions in North America plus Central Europe yields a very clear story. Using lumber prices from late August 2024, a standard product grade out turn with current prices for lumber revenue was developed for the BC Interior, US Pacific Northwest, US Inland, the US South and Central Europe. The now current 14.54 per cent US import duties were applied to BC sawmills’ revenue on their US exports.

Sawmill operating costs (including overhead) at top-quartile mills in each region were estimated and deducted from the calculated lumber revenue. In the table above, the earnings that resulted were then expressed as a percentage of the lumber revenue with the following results (ALL negative except the US Inland region, although results vary between mills in the same region).

The results for more typical sawmills would be worse; essentially negative in all regions of North America given their higher costs. Of note, the US Inland region sawmills had the best earning results mainly because of a lumber sales average (FOB mill) that was US$80/Mbf higher (+22 per cent) than W-SPF and US$130/Mbf higher (+43 per cent) than SYP-West. The estimated sawmill margins for German exporters to the US were the worst: in the -20 to -30 per cent range.

While this is a somewhat simplified analysis, it does show why sawmill curtailments have been occurring throughout the West and in the US South. Permanent mill closures at high-cost mills have also been occurring in BC, the US Pacific Northwest regions and the US South. Increased North American sawmill curtailments (and reduced European exports to the US) are required to get lumber prices moving upward again, but that looks to be a slow process, at least so far.

Russ Taylor, President of Russ Taylor Global