BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.9 per cent on a year-over-year basis in May, up from a 2.7 per cent increase in April. Month-over-month, on a seasonally adjusted basis, CPI rose by 0.3 per cent in May.

The acceleration in headline CPI was driven by rising prices for services, especially cellular, travel, rents, and air transport.

The shelter cost index remains the major driver of inflation with the rate of increases higher now (6.4 per cent) than they were this time last year (4.7 per cent). Mortgage interest costs were up 23.3 per cent and rent was up 8.6 per cent from the same time last year in May. Excluding shelter, consumer prices rose just 1.5 per cent, year over year.

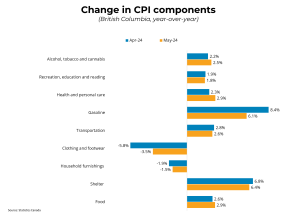

In BC, consumer prices rose 2.9 per cent year-over-year, unchanged from April. The Bank of Canada‘s preferred measures of core inflation, which strip out volatile components, fell to between 2.4 and 2.9 per cent per cent year-over-year in May.

Canada’s inflation rate came in higher than expected in May, halting a string of good reports since the start of the year. The Bank of Canada’s preferred measures of core inflation, CPI median and CPI trim, jumped back above the 2 per cent target when measured on a 3-month annualized basis. Food prices ticked up sharply last month after remaining flat or declining in every prior month since the start of the year.

Rents remain the most troubling component of the CPI bundle, and still show no signs of slowing down. Rents rose 9.3 percent over the last 4 months on an annualized basis. While one month does not make a trend, the probability of an additional rate cut by the Bank of Canada in July declined following the report. The Bank will be watching the forthcoming employment and GDP reports closely to guide its decision prior to the next announcement on Wednesday, July 24th.

Source: bcrea.bc.ca