BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 3.1 per cent on a year-over-year basis in October, down from 3.8 per cent in September.

BRITISH COLUMBIA – Canadian prices, as measured by the Consumer Price Index (CPI), rose 3.1 per cent on a year-over-year basis in October, down from 3.8 per cent in September.

Excluding gasoline, CPI rose 3.6 per cent year-over-year in October. Shelter costs continue to be the main driver of inflation, with mortgage interest costs up 30.5 per cent and rent up 8.2 per cent. Grocery price inflation continued to moderate, albeit slowly and still elevated at 5.4 per cent year-over-year. Month over month, seasonally adjusted CPI fell 0.1 per cent, largely as a result of falling gasoline prices.

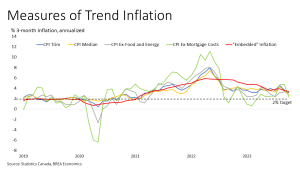

In BC, consumer prices rose 2.7 per cent year-over-year. The Bank of Canada‘s preferred measures of core inflation showed significant downward momentum for the first time in months, falling to around 3.5 per cent year-over-year after trending near 4 per cent since the spring.

While the main contributor to lower inflation this month was falling gas prices, there were other strong signs of progress on inflation that should please the Bank of Canada. The three-month trend in core inflation measures fell to between 2.7 and 3.1 per cent and inflation excluding mortgage interest costs fell to just 2.2 per cent. Those trends, along with slowing GDP growth and early signs of a weakening labour market, should keep the Bank of Canada sidelined in December and looking to lower rates in 2024.

Source: bcrea.bc.ca