Canadian Exchange IPOs/Canadian Exchange IPOs (non-CPC/SPAC) (CNW Group/CPE Media Inc.)

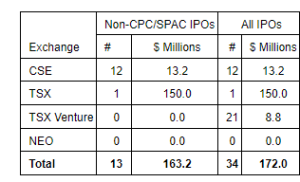

BRITISH COLUMBIA – 34 Canadian initial public offerings (IPOs) completed on the Canadian exchanges in the first half of 2023, raising $172 million or $163 million from 13 IPOs, excluding Capital Pool Company (CPC) and special purpose acquisition corporation (SPAC) IPOs, reported by CPE Analytics.

Based on annualized results from the first half results, 2023 would be on its way to raise $344 million and become the worst IPO year in term of total amount raised, representing less than 50% of the $799 million raised in 2016, the previous worse IPO year since 2016.

The extraordinary quietness of Canadian IPO activities in the first half of 2023 can be summarized in four words: CSE, Mining, BC and CPC.

Canadian Securities Exchange (CSE)

12 Canadian IPOs completed on the CSE, accounting for 92% of Canadian non-CPC/SPAC IPOs or 35% of all Canadian exchange IPOs.

Mining

12 Canadian Mining IPOs, 11 of which on the CSE, completed for gross proceeds of $157 million, accounting for 96% of total amount raised by non-CPC/SPAC IPOs or 91% of all IPOs on Canadian exchanges.

Lithium Royalty Corp.’s $150 million IPO on TSX accounted for 95% of the total mining IPO amount, 92% of all non-CPC/SPAC IPO amount or 87% of all IPO amount.

British Columbia (BC)

24 IPOs completed by BC companies for $11 million, accounting for 71% of the total number of all IPOs.

Excluding CPC/SPAC, 11 IPOs completed by BC companies for $7, accounting for 85% of the total number of non-CPC/SPAC IPOs. 2 Ontario IPOs accounted for the remaining 15% of non-CPC/SPAC IPOs.

Capital Pool Company (CPC)

21 CPC IPOs completed on TSX Venture Exchange (TSX-V) for $9 million, accounting for 62% of all IPOs. IPOs on TSX-V in the first half were exclusively CPC.

First Half of 2023 Canadian IPOs by Exchange. @cpecompany.ca

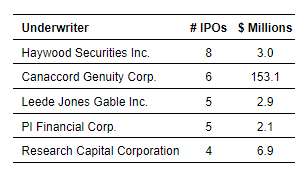

1st Half of 2023 Canadian IPOs: Top Five Underwriters. @cpecompany.ca

1st Half of 2023 Canadian IPOs on foreign exchange

U.S. GoldMining Inc. (NASDAQ: USGO) – US $20 million

Lucy Scientific Discovery Inc. (NASDAQ: LSDI) – US $5.8 million

CPC – capital pool company

SPAC – special purpose acquisition corporation also known as blank check company in the US

Included:

Canadian exchange (CSE, TSX, TSX-V, NEO) or cross-listed Canadian/foreign exchange IPOs, by both Canadian and foreign firms.

Excluded:

- IPOs by Canadian firms solely on foreign exchanges

- ETFs/closed-end funds, publicly listed or non-listed investment funds

- Non-offering listings by qualification of distribution of previously issued securities

- Reverse take-overs (RTOs), qualifying transactions (QTs), qualifying acquisitions (QAs)

CPE Analytics is the data analytics division of CPE Media & Data Company. https://cpeanalytics.ca