BRITISH COLUMBIA – The dashboard created by the BCREA Economics team focuses on the sectors and activities that have been most significantly impacted by the pandemic and the province’s state of emergency.

To monitor the province’s progress, we benchmark each indicator to February 2020, the month before the pandemic was declared. This dashboard will be updated each month.

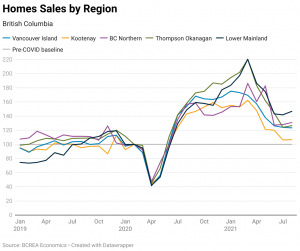

Housing Markets

Housing Markets

As BC households and the real estate sector adhered to physical distancing measures during the early part of the pandemic, home sales and new listings dropped dramatically. Since then, pent-up demand, record-low borrowing rates and the desire for more space have pushed up homes sales to levels not seen since 2017.

Retail, Restaurant Reservations and Movement

The initial period of the shutdown saw the closure of physical stores and restaurants, negatively impacting retail sales and restaurant reservations. This, combined with many people working from home, dramatically decreased movement in retail and restaurant spaces, public transit, and workplaces. As the province relaxed restrictions, retail sales bounced back, and restaurant reservations resumed but at a slow pace.

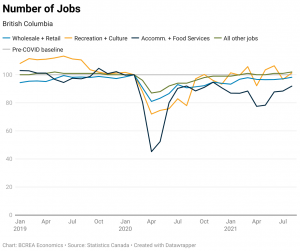

Jobs and Hours Worked

Jobs and Hours Worked

The three sectors highlighted here are those that have been most significantly impacted by the province’s state of emergency. Jobs in wholesale and retail, recreation and culture, and accommodation and food services have almost bounced back to pre-pandemic levels from record losses in the spring of 2020, but hours worked are still lagging. High-wage jobs have seen growth in employment, while employment in low- to mid-wage sectors has not yet recovered.

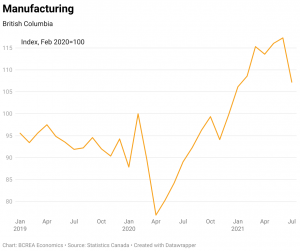

Manufacturing and International Trade

Manufacturing and International Trade

Manufacturing plants in BC either shutdown or operated at limited capacity due to the state of emergency in the first half of 2020. Moreover, falling energy prices and weaker global demand for goods resulted in drastic decreases in BC’s exports and imports.

Operations in manufacturing have resumed, led by durable goods such as wood and furniture products. International trade has rebounded on the heels of forestry and metal ore exports, while imports have benefited from consumer goods, electronics, and machinery and equipment.

Business and Consumer Confidences

Business confidence is measured through a survey of small businesses in BC on their expectations and operating conditions, which were negatively impacted by the state of emergency. Business confidence has since improved as the rollout of a vaccine has led many businesses to expect a rise in sales in 2021.

Consumer confidence is measured through a survey of BC households on their optimism around current economic conditions (e.g., employment, financial, and major purchases), which has been clouded with continued uncertainty amid rising COVID-19 infections and tightened restrictions.

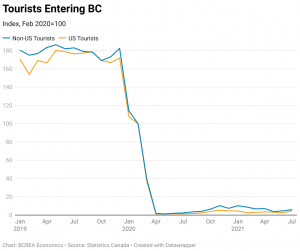

Tourism

Tourism

The closing of the border to international travel, physical distancing measures that reduced domestic travel, and the shutdown of attractions has resulted in a dramatic decline in the tourism sector in BC.