VICTORIA – Steady demand for office product in Class AA & A space throughout Greater Victoria led to minimal changes quarter-over-quarter. Overall vacancy rates for Class AA & A decreased 250 bps from Q1, reaching 4.6 per cent. Blended Class A rates decreased 5.6 per cent quarter-over-quarter, reaching $26.49 per sq.ft.

The total average asking rate experienced a 2.1 per cent decrease quarter-over-quarter. Primary drivers for the decrease in net asking rates comes from Blended Class A product, while Class B & C experienced quarterly increases.

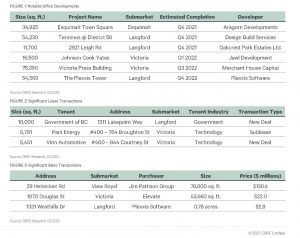

Throughout the entire region, there is just under a quarter million sq.ft. currently under construction. Delivery timelines for these projects span through to 2023, most notably the Victoria Press Building which is slated to complete in late 2022. Out of the aggregate of space currently under construction, 62.9 per cent is focused to suburban markets. As well, 40.0 per cent of the space currently under construction has been pre-leased. This included the Ontario tech firm Plexxis Software’s new headquarters in Plexxis Tower and a new co-working operator, Langford Business Centre, opening in Terminus at District 56.

Vacancy Rate: 6.8 % ⇓

Looking Forward

As BC continues to progress and ease health and safety restrictions in accordance with the BC Restart Plan, daytime traffic within Victoria’s downtown core shows signs of recovery. Published by the City of Victoria, measures of pedestrian, bicycle and vehicle counts in 02 2021 are greater than that of the previous year, however, have not yet fully recovered to pre-pandemic levels. Vacancy rates throughout the Downtown core experienced a 50-basis point decrease quarter-over-quarter, with Class C inventory holding the highest vacancy rate of 8.5 per cent. Significant activity comes from the Government of BC renewing their 105,268 sq. ft. premises at 1001 Douglas Street.

SF Construction: 247,314 ⇑

Looking forward, a gradual increase in demand and downward pressure on vacancy rates can be expected as workers begin to return to the office. Especially now given that public sector entities have not shown any signs of reducing their floorplates. Healthy demand for office product has spurred the proposal of two significant developments. Telus Ocean is slated to bring 150,000 sq. ft. of gross leasable space of 11 storeys. As well, Jawl Properties has proposed to redevelop the former Capital 6 theatre site into 152,000 sq. ft. of leasable space over 9 storeys. If approved, both projects will not be ready for occupancy until 2024 at the earliest.

NNN/Lease Rate: $19.71 ⇓

Suburban Markets

Four of Greater Victoria’s suburban markets (Langford, Colwood, View Royal and Sooke) are in the top 10 fastest growing communities of British Columbia larger than 5,000 people. Nearly half of the 247,314 sq. ft. of office space currently under construction in Greater Victoria comes from within these Westshore communities. As well, an estimated 43.0 per cent of the space under construction in these communities have already been pre-leased. The increased demand within these suburban markets can be attributed to increased housing affordability and shifting workplace cultures. However, occupiers are limited by the number of opportunities larger than 5,000 sq. ft. as there is only one existing and available option within the suburban regions.

Competitive land pricing coupled with development friendly policy in these Suburban markets has created opportunity for owner-users to enter the market. Plexxis Software serves as a perfect example as they will be occupying the top two floors at Plexxis Tower, which when complete in 2023, will bring 54,000 sq. ft. of Class A inventory online. Alternatively, the Government of BC is investing $2.2M in leasing over 10,000 sq. ft of office space as a pilot, mobile-only, office for civil servants at 13111 Lakepoint Way. As over one-fifth of public service employees live in suburban communities, the goal is to expand this project.